Introduction

In the ever-fluctuating world of the stock market, the specter of risk looms large for investors. While the allure of high returns can be enticing, the potential for sudden market downturns cannot be ignored.

This is where the concept of hedging comes into play—a risk management strategy designed to protect investment portfolios against adverse movements in the market.

Hedging can be likened to taking out an insurance policy; it may come with a cost, but the protection it offers can be invaluable during times of uncertainty.

Read More: Is This Stock About to Shock Both Investors and Skeptics?

Understanding the Risks

Before delving into hedging strategies, it’s crucial to understand the types of risks that investors face.

Systematic risk, also known as market risk, is inherent to the entire market and cannot be eliminated through diversification. It’s influenced by factors like economic recessions, political instability, and changes in interest rates.

On the other hand, unsystematic risk is specific to a particular company or industry and can be mitigated through diversification. Recognizing the difference between these risks is critical to developing effective hedging strategies.

Hedging Strategies:

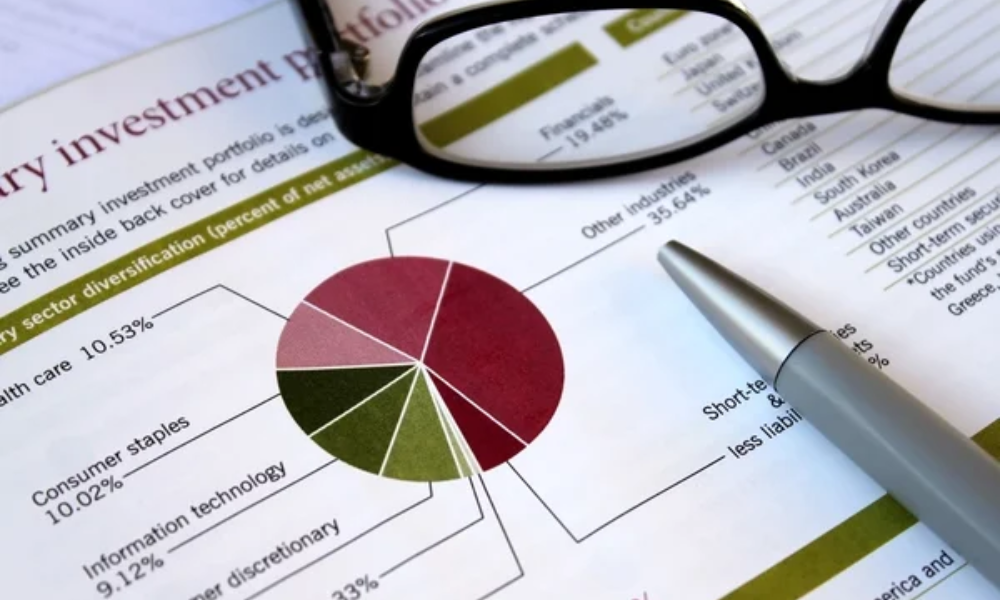

Diversification

One of the most fundamental hedging strategies is diversification. By spreading investments across various sectors, asset classes, and geographical regions, investors can reduce the impact of poor performance in any single investment.

Diversification is often the first line of defense against market volatility, helping to smooth out the ups and downs over time.

Options

Options contracts offer another way to hedge against potential losses. A put option, for example, gives the holder the right to sell a stock at a predetermined price, providing a safety net if the stock price plummets.

Conversely, call options can protect against missed opportunities in rising markets. While options can be effective, they require a nuanced understanding of the market to use effectively.

Futures

Futures contracts can also serve as a hedging tool. Investors can lock in prices for selling or buying assets at a future date, thus hedging against price fluctuations.

This strategy is particularly popular in commodity markets but can be applied to stock portfolios as well. However, futures contracts involve leverage, which can magnify gains and losses.

Asset Allocation

Another hedging strategy is adjusting the mix of asset types—stocks, bonds, real estate, cash, etc.—in a portfolio. Typically, bonds and stocks move inversely to each other.

Increasing the bond allocation during volatile stock market periods can provide stability to the portfolio. This strategy requires regular rebalancing to maintain the desired risk level.

Also Read: Stocks Likely to Withstand Market Downturn if Interest Rate Reductions Postpone, Economist Suggests

Stop Loss Orders

Implementing stop loss orders is a direct way to limit potential losses. By setting a predetermined selling price, investors can ensure that their holdings are automatically sold before incurring significant losses.

While stop loss orders can prevent large losses, they can also result in the sale of assets during short-term market dips, potentially missing out on subsequent recoveries.

Considerations and Costs

It’s important to note that hedging is not without its costs. Options contracts, for instance, come with premiums. Moreover, hedging strategies can cap potential gains – just as they protect against losses.

Therefore, the decision to hedge should be weighed carefully, considering both the portfolio’s risk tolerance and the investor’s financial goals. It’s also crucial to stay informed about market conditions and adjust hedging strategies as needed – to align with changing market dynamics.

Conclusion

In the tumultuous seas of the stock market, hedging serves as an essential navigational tool for investors seeking to safeguard their portfolios against unexpected storms.

While no strategy can guarantee complete immunity from risk, a well-hedged portfolio can weather market volatility with greater resilience.

Read Next: Palantir Stock is Surging: Is it Too Late to Invest?

DISCLAIMER

You should read and understand this disclaimer in its entirety before joining or viewing the website or email/blog list of SmallCapStocks.com (the “Publisher”). The information (collectively the “Advertisement”) disseminated by email, text or other method by the Publisher including this publication is a paid commercial advertisement and should not be relied upon for making an investment decision or any other purpose. The Publisher is engaged in the business of marketing and advertising the securities of publicly traded companies in exchange for compensation. The track record, gains, upside, and/or losses mentioned in the Advertisement, if any, should not be considered as true or accurate or be the basis for an investment. The Publisher does not verify the accuracy or completeness of any information included in the Advertisement. While the Publisher does not charge for the SMS service, standard carrier message and data rates may apply. To unsubscribe from receiving promotional text messages to your phone sent via an autodialer, using your phone reply to the sender’s phone number with the word STOP or HELP for help.

The Advertisement is not a solicitation or recommendation to buy securities of the advertised company. An offer to buy or sell securities can be made only by a disclosure document that complies with applicable securities laws and only in the states or other jurisdictions in which the security is eligible for sale. The Advertisement is not a disclosure document. The Advertisement is only a favorable snapshot of unverified information about the advertised company. An investor considering purchasing the securities, should always do so only with the assistance of his legal, tax and investment advisors. Investors should review with his or her investment advisor, tax advisor or attorney, if and to the extent available, any information concerning a potential investment at the web sites of the U.S. Securities and Exchange Commission (the "SEC") at www.sec.gov; the Financial Industry Regulatory Authority (the "FINRA") at www.FINRA.org, and relevant State Securities Administrator website and the OTC Markets website at www.otcmarkets.com. The Publisher cautions investors to read the SEC advisory to investors concerning Internet Stock Fraud at www.sec.gov/consumer/cyberfr.htm, as well as related information published by the FINRA on how to invest carefully. Investors are responsible for verifying all information in the Advertisement. As an advertiser, we do not verify any information we publish. The Advertisement should not be considered true or complete.

The Publisher does not offer investment advice or analysis, and the Publisher further urges you to consult your own independent tax, business, financial and investment advisors concerning any investment you make in securities particularly those quoted on the OTC Markets. Investing in securities is highly speculative and carries an extremely high degree of risk. You could lose your entire investment if you invest in any company mentioned in the Advertisement. You acknowledge that we are not an investment advisory service, a broker-dealer or an investment adviser and we are not qualified to act as such. You acknowledge that you will consult with your own independent, tax, financial and/or legal advisers regarding any decisions as to any company mentioned here. We have not determined if the Advertisement is accurate, correct or truthful. The Advertisement is compiled from publicly available information, which include, but are not limited to, no cost online research, magazines, newspapers, reports filed with the SEC or information furnished by way of press releases. Because all information relied upon by us in preparing an advertisement about an issuer comes from a public source, it is not reliable, and you should not assume it is accurate or complete.

By your subscription to our profiles, the viewing of this profile and/or use of our website, you have agreed and acknowledged the terms of our full disclaimer and privacy policy which can be viewed at the following link: www.SmallCapStocks.com/Disclaimer and www.SmallCapStocks.com/Privacy-Policy

By accepting the Advertisement, you agree and acknowledge that any hyperlinks to the website of (1) a client company, (2) the party issuing or preparing the information for the company, or (3) other information contained in the Advertisement is provided only for your reference and convenience. The advertiser is not responsible for the accuracy or reliability of these external sites, nor is it responsible for the content, opinions, products or other materials on external sites or information sources. If you use, act upon or make decisions in reliance on information contained in any disseminated report/release or any hyperlink, you do so at your own risk and agree to hold us, our officers, directors, shareholders, affiliates and agents harmless. You acknowledge that you are not relying on the Publisher, and we are not liable for, any actions taken by you based on any information contained in any disseminated email or hyperlink.