The latest stock gains are anticipated to persist through the year’s end, weathering any mid-year market adjustments, contingent on central banks delaying interest rate reductions beyond current market expectations.

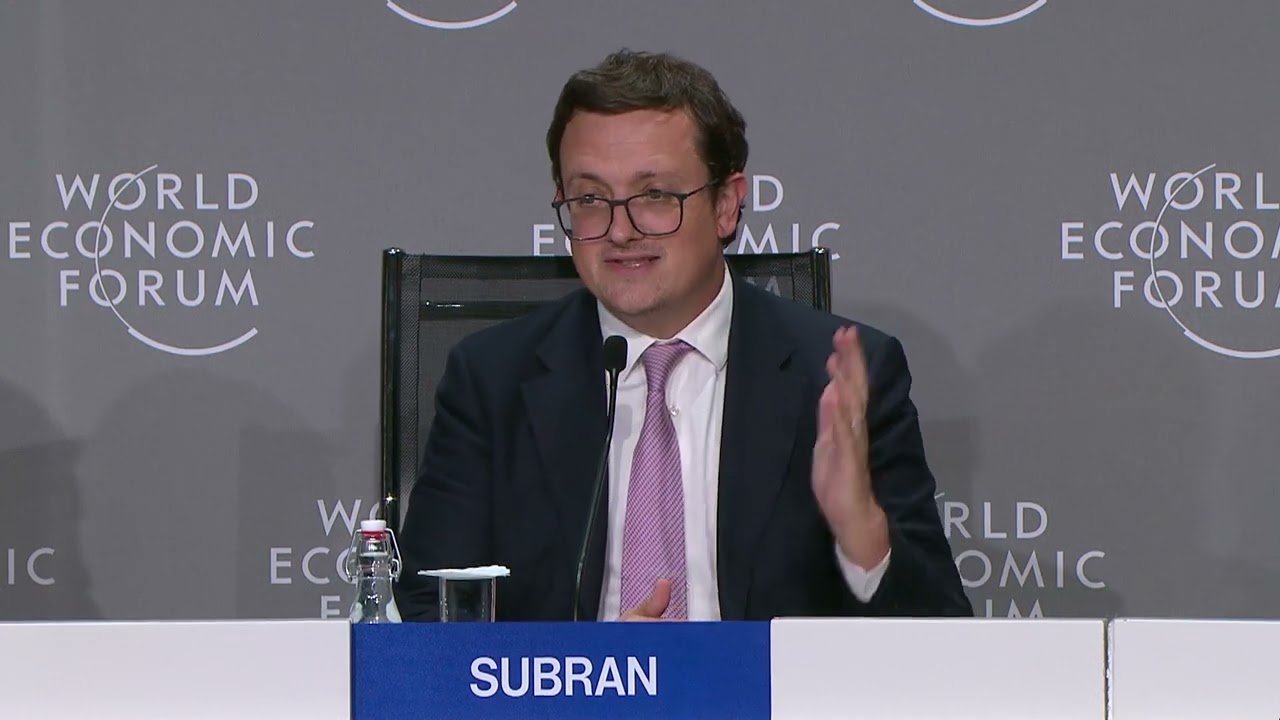

Despite potential seasonal fluctuations, the markets might adjust to a new trajectory for rate cuts from central banks, suggests Ludovic Subran, Allianz’s chief economist.

Read More: Palantir Stock is Surging: Is it Too Late to Invest?

Market Expectations vs. Central Bank Moves

Investors are currently bracing for a significant shift in central bank policies, expecting an early pivot. However, Subran points out that indications now lean towards a mid-year pivot, possibly smaller than initially anticipated.

“That means substantial volatility ahead, when people are going to re-rate,” Subran mentioned, emphasizing that the gains seen in late 2023 and early 2024 should remain by year-end.

Recent Stock Market Performance

The final two months of 2023 saw European stocks surge, with the Stoxx 600 index achieving a 12.7% annual gain. Similarly, the U.S. S&P 500 has been climbing since late October, recently surpassing the 5,000 mark for the first time.

Also Read: Is This Logistics and B2B Marketplace Operator a Buy?

Earnings Season and Market Sentiment

The current earnings season has been robust, with only minor market sentiment disturbances from some central bankers tempering rate cut expectations, particularly in Europe.

“I think it’s going to be very seasonal,” Subran predicted, foreseeing a potential correction as investors adjust to the reality of more modest central bank pivots due to U.S. growth resilience or persistent inflation in Europe.

Year-End Outlook

Despite these challenges, Subran remains optimistic about the year’s investment returns.

“By the end of the year, we’re going to have quite some good 5-10% equity returns,” he stated, viewing this as a positive outcome in a year marked by broader economic normalization.

Read Next:Energy Secretary Expresses US’s Deep Concerns Over China’s Control in Critical Minerals Market

DISCLAIMER

You should read and understand this disclaimer in its entirety before joining or viewing the website or email/blog list of SmallCapStocks.com (the “Publisher”). The information (collectively the “Advertisement”) disseminated by email, text or other method by the Publisher including this publication is a paid commercial advertisement and should not be relied upon for making an investment decision or any other purpose. The Publisher is engaged in the business of marketing and advertising the securities of publicly traded companies in exchange for compensation. The track record, gains, upside, and/or losses mentioned in the Advertisement, if any, should not be considered as true or accurate or be the basis for an investment. The Publisher does not verify the accuracy or completeness of any information included in the Advertisement. While the Publisher does not charge for the SMS service, standard carrier message and data rates may apply. To unsubscribe from receiving promotional text messages to your phone sent via an autodialer, using your phone reply to the sender’s phone number with the word STOP or HELP for help.

The Advertisement is not a solicitation or recommendation to buy securities of the advertised company. An offer to buy or sell securities can be made only by a disclosure document that complies with applicable securities laws and only in the states or other jurisdictions in which the security is eligible for sale. The Advertisement is not a disclosure document. The Advertisement is only a favorable snapshot of unverified information about the advertised company. An investor considering purchasing the securities, should always do so only with the assistance of his legal, tax and investment advisors. Investors should review with his or her investment advisor, tax advisor or attorney, if and to the extent available, any information concerning a potential investment at the web sites of the U.S. Securities and Exchange Commission (the "SEC") at www.sec.gov; the Financial Industry Regulatory Authority (the "FINRA") at www.FINRA.org, and relevant State Securities Administrator website and the OTC Markets website at www.otcmarkets.com. The Publisher cautions investors to read the SEC advisory to investors concerning Internet Stock Fraud at www.sec.gov/consumer/cyberfr.htm, as well as related information published by the FINRA on how to invest carefully. Investors are responsible for verifying all information in the Advertisement. As an advertiser, we do not verify any information we publish. The Advertisement should not be considered true or complete.

The Publisher does not offer investment advice or analysis, and the Publisher further urges you to consult your own independent tax, business, financial and investment advisors concerning any investment you make in securities particularly those quoted on the OTC Markets. Investing in securities is highly speculative and carries an extremely high degree of risk. You could lose your entire investment if you invest in any company mentioned in the Advertisement. You acknowledge that we are not an investment advisory service, a broker-dealer or an investment adviser and we are not qualified to act as such. You acknowledge that you will consult with your own independent, tax, financial and/or legal advisers regarding any decisions as to any company mentioned here. We have not determined if the Advertisement is accurate, correct or truthful. The Advertisement is compiled from publicly available information, which include, but are not limited to, no cost online research, magazines, newspapers, reports filed with the SEC or information furnished by way of press releases. Because all information relied upon by us in preparing an advertisement about an issuer comes from a public source, it is not reliable, and you should not assume it is accurate or complete.

By your subscription to our profiles, the viewing of this profile and/or use of our website, you have agreed and acknowledged the terms of our full disclaimer and privacy policy which can be viewed at the following link: www.SmallCapStocks.com/Disclaimer and www.SmallCapStocks.com/Privacy-Policy

By accepting the Advertisement, you agree and acknowledge that any hyperlinks to the website of (1) a client company, (2) the party issuing or preparing the information for the company, or (3) other information contained in the Advertisement is provided only for your reference and convenience. The advertiser is not responsible for the accuracy or reliability of these external sites, nor is it responsible for the content, opinions, products or other materials on external sites or information sources. If you use, act upon or make decisions in reliance on information contained in any disseminated report/release or any hyperlink, you do so at your own risk and agree to hold us, our officers, directors, shareholders, affiliates and agents harmless. You acknowledge that you are not relying on the Publisher, and we are not liable for, any actions taken by you based on any information contained in any disseminated email or hyperlink.

Dean is a freelance content writer who contributes to various Digital Media Companies and independent websites all over the world. He has over 20 years of financial industry experience, so it’s safe to say he’s well informed.