Managing money effectively is a skill that can be the difference between financial freedom and struggling to make ends meet.

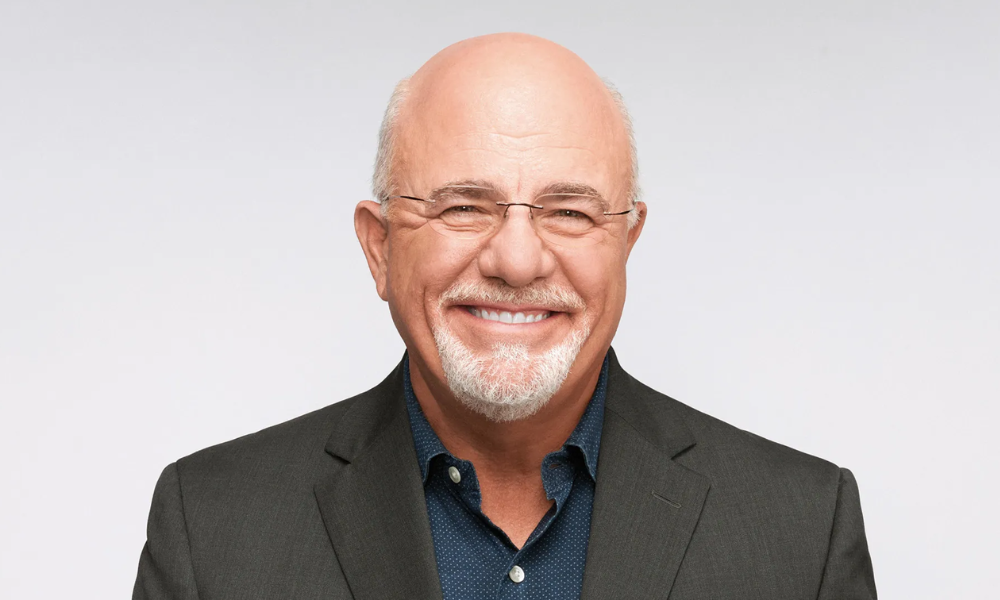

Dave Ramsey, a renowned financial expert, radio host, and best-selling author, is famous for his ‘no nonsense’ advice on managing money.

Here are some key money management tips inspired by Dave Ramsey’s principles.

Create a Budget and Stick to It

One of Dave Ramsey’s fundamental principles is the importance of creating and following a budget. A budget serves as a roadmap for your finances, helping you track your income, expenses, and savings goals.

Start by listing all sources of income and categorizing your expenses, including necessities like housing, utilities, groceries, and transportation, as well as discretionary spending. Allocate a portion of your income to savings and debt repayment, prioritizing high-interest debt like credit cards.

Regularly review and adjust your budget as needed to ensure you stay on track toward your financial goals.

Live Below Your Means

Living below your means is a key tenet of Dave Ramsey’s financial philosophy. This means spending less than you earn and avoiding unnecessary debt. Instead of succumbing to lifestyle inflation and overspending, adopt a frugal mindset and prioritize needs over wants.

Look for ways to cut expenses, such as dining out less frequently, finding cheaper alternatives for entertainment, and avoiding impulse purchases. By living below your means, you can free up more money to save, invest, and build wealth over time.

Emergency Fund

Dave Ramsey emphasizes the importance of having an emergency fund to cover unexpected expenses or financial setbacks. Aim to save three to six months’ worth of living expenses in a dedicated emergency fund. This money should be easily accessible in a high-yield savings account or money market fund.

Having an emergency fund provides a financial safety net and peace of mind, allowing you to weather unforeseen circumstances like job loss, medical emergencies, or car repairs without resorting to high-interest debt or depleting your savings.

Debt Snowball Method

For those struggling with debt, Dave Ramsey recommends using the debt snowball method to pay off outstanding balances efficiently. Start by listing all your debts from smallest to largest, regardless of interest rate. Focus on paying off the smallest debt first while making minimum payments on other debts.

Once the smallest debt is paid off, roll the amount you were paying toward that debt into the next smallest debt, and so on. This snowball effect accelerates debt repayment and provides motivation as you see progress with each debt paid off.

Avoid High-Interest Debt

Avoiding high-interest debt, particularly credit card debt, is crucial for financial stability and debt freedom. Dave Ramsey advises against using credit cards for everyday purchases and recommends paying with cash or debit cards instead.

If you currently have credit card debt, prioritize paying it off as quickly as possible using the debt snowball method. Once you’ve paid off your debts, commit to using credit responsibly or consider cutting up your credit cards altogether to prevent future temptation.

Invest for the Future

Investing for the future is essential for building wealth and achieving long-term financial goals. Dave Ramsey recommends starting with employer-sponsored retirement plans like 401(k)s or individual retirement accounts (IRAs).

Contribute consistently to these accounts and take advantage of any employer matching contributions. Invest in a diversified portfolio of low-cost index funds or mutual funds with a long-term perspective. Avoid speculative investments or trying to time the market, and focus on consistent, disciplined investing over time.

Give Generously

Finally, Dave Ramsey advocates for the importance of giving generously, whether through charitable donations, volunteering time, or helping those in need. Giving back not only benefits others but also brings fulfilment and joy to your own life.

Incorporate giving into your budget and make it a priority alongside savings and debt repayment. By cultivating a spirit of generosity, you can make a positive impact on your community and contribute to a better world.

Dave’s Money Tips for Success

Dave Ramsey’s money management tips provide valuable insights for achieving financial success and security. By creating a budget, living below your means, building an emergency fund, paying off debt, investing for the future, and giving generously, you can take control of your finances and build a solid foundation for a brighter financial future.

With discipline, perseverance, and a commitment to financial principles, you can achieve your financial goals and enjoy greater peace of mind and financial freedom.

DISCLAIMER

You should read and understand this disclaimer in its entirety before joining or viewing the website or email/blog list of SmallCapStocks.com (the “Publisher”). The information (collectively the “Advertisement”) disseminated by email, text or other method by the Publisher including this publication is a paid commercial advertisement and should not be relied upon for making an investment decision or any other purpose. The Publisher is engaged in the business of marketing and advertising the securities of publicly traded companies in exchange for compensation. The track record, gains, upside, and/or losses mentioned in the Advertisement, if any, should not be considered as true or accurate or be the basis for an investment. The Publisher does not verify the accuracy or completeness of any information included in the Advertisement. While the Publisher does not charge for the SMS service, standard carrier message and data rates may apply. To unsubscribe from receiving promotional text messages to your phone sent via an autodialer, using your phone reply to the sender’s phone number with the word STOP or HELP for help.

The Advertisement is not a solicitation or recommendation to buy securities of the advertised company. An offer to buy or sell securities can be made only by a disclosure document that complies with applicable securities laws and only in the states or other jurisdictions in which the security is eligible for sale. The Advertisement is not a disclosure document. The Advertisement is only a favorable snapshot of unverified information about the advertised company. An investor considering purchasing the securities, should always do so only with the assistance of his legal, tax and investment advisors. Investors should review with his or her investment advisor, tax advisor or attorney, if and to the extent available, any information concerning a potential investment at the web sites of the U.S. Securities and Exchange Commission (the "SEC") at www.sec.gov; the Financial Industry Regulatory Authority (the "FINRA") at www.FINRA.org, and relevant State Securities Administrator website and the OTC Markets website at www.otcmarkets.com. The Publisher cautions investors to read the SEC advisory to investors concerning Internet Stock Fraud at www.sec.gov/consumer/cyberfr.htm, as well as related information published by the FINRA on how to invest carefully. Investors are responsible for verifying all information in the Advertisement. As an advertiser, we do not verify any information we publish. The Advertisement should not be considered true or complete.

The Publisher does not offer investment advice or analysis, and the Publisher further urges you to consult your own independent tax, business, financial and investment advisors concerning any investment you make in securities particularly those quoted on the OTC Markets. Investing in securities is highly speculative and carries an extremely high degree of risk. You could lose your entire investment if you invest in any company mentioned in the Advertisement. You acknowledge that we are not an investment advisory service, a broker-dealer or an investment adviser and we are not qualified to act as such. You acknowledge that you will consult with your own independent, tax, financial and/or legal advisers regarding any decisions as to any company mentioned here. We have not determined if the Advertisement is accurate, correct or truthful. The Advertisement is compiled from publicly available information, which include, but are not limited to, no cost online research, magazines, newspapers, reports filed with the SEC or information furnished by way of press releases. Because all information relied upon by us in preparing an advertisement about an issuer comes from a public source, it is not reliable, and you should not assume it is accurate or complete.

By your subscription to our profiles, the viewing of this profile and/or use of our website, you have agreed and acknowledged the terms of our full disclaimer and privacy policy which can be viewed at the following link: www.SmallCapStocks.com/Disclaimer and www.SmallCapStocks.com/Privacy-Policy

By accepting the Advertisement, you agree and acknowledge that any hyperlinks to the website of (1) a client company, (2) the party issuing or preparing the information for the company, or (3) other information contained in the Advertisement is provided only for your reference and convenience. The advertiser is not responsible for the accuracy or reliability of these external sites, nor is it responsible for the content, opinions, products or other materials on external sites or information sources. If you use, act upon or make decisions in reliance on information contained in any disseminated report/release or any hyperlink, you do so at your own risk and agree to hold us, our officers, directors, shareholders, affiliates and agents harmless. You acknowledge that you are not relying on the Publisher, and we are not liable for, any actions taken by you based on any information contained in any disseminated email or hyperlink.

I’m Marcus Reynolds, a versatile writer known for connecting the dots between various news topics. My writing offers clear and thought-provoking insights into current events worldwide. I strive to keep you informed and engaged, making the ever-evolving world of news easier to navigate and understand.