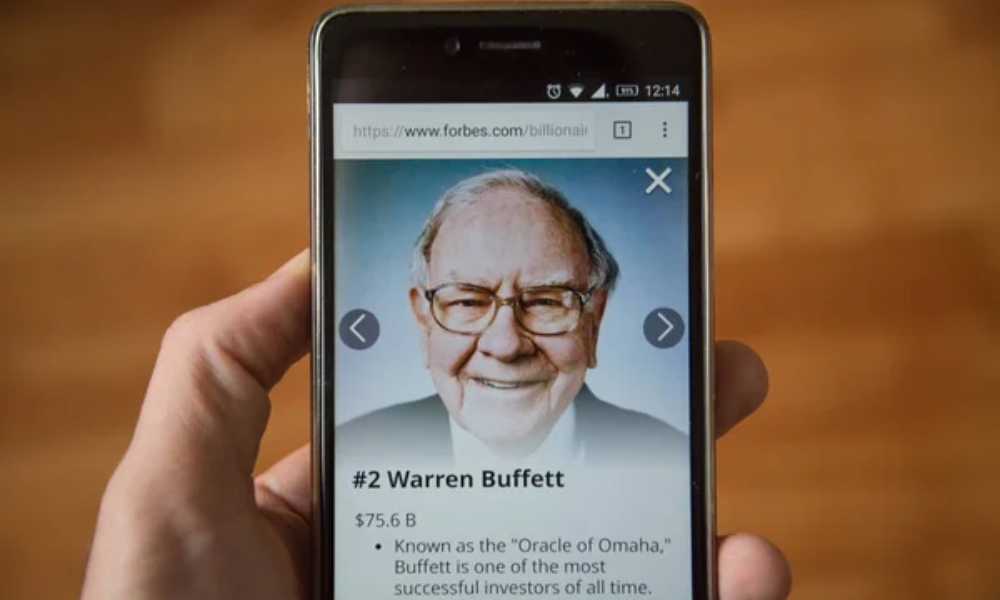

Warren Buffett, one of the most successful investors of all time, has amassed a wealth of knowledge on money management. His investment strategies and financial wisdom have guided countless individuals toward financial success.

Below are some of his most valuable money management tips.

Live Below Your Means

Warren Buffett is known for his frugality. Despite his vast wealth, he lives a modest lifestyle, residing in the same house he purchased in 1958. His approach to living below one’s means is a cornerstone of sound financial management.

Buffett advises against the common tendency to increase spending with increased income. Instead, maintaining a frugal lifestyle allows for greater savings and investment opportunities, which can lead to long-term financial growth.

Invest in What You Understand

One of Buffett’s key investment principles is to invest in businesses that are easy to understand. He emphasizes the importance of understanding the industry, the company’s business model, and its competitive advantages.

This approach minimizes risk and allows for more informed decision-making. By sticking to what is known, investors can avoid costly mistakes that often arise from investing in unfamiliar or overly complex businesses.

Focus on Long-Term Investments

Buffett is a strong advocate for long-term investing. He believes that the stock market is designed to transfer money from the active to the patient. Rather than seeking quick profits through frequent trading,

Buffett recommends buying quality stocks and holding onto them for extended periods. This strategy allows investments to grow and compound over time, capitalizing on the power of compound interest.

Avoid Debt

Avoiding unnecessary debt is another crucial aspect of Buffett’s financial philosophy. High-interest debt, such as credit card debt, can quickly erode wealth and hinder financial growth.

Buffett advises keeping debt levels low and paying off any high-interest debts as soon as possible. By avoiding debt, individuals can keep more of their money working for them through investments and savings.

Invest in Yourself

Buffett often emphasizes the importance of self-investment. He considers education and personal development as the best investments one can make. Developing skills, expanding knowledge, and improving oneself can lead to better career opportunities and increased earning potential.

Buffett encourages continuous learning and self-improvement as a means to achieve financial and personal success.

Value Quality Over Quantity

In investing, Buffett places a high value on quality over quantity. He prefers to invest in a few high-quality companies rather than spreading investments too thin across numerous mediocre ones.

This principle can also be applied to personal spending. Investing in high-quality items that last longer can be more cost-effective than frequently replacing cheaper, lower-quality items.

Stay Disciplined

Discipline is a critical component of Buffett’s approach to money management. He advises maintaining a disciplined approach to saving, investing, and spending. This includes setting financial goals, creating a budget, and sticking to it.

Discipline helps in avoiding impulsive financial decisions and staying on track toward long-term financial objectives.

Be Prepared for Market Volatility

Buffett acknowledges that market volatility is an inevitable part of investing. Rather than fearing market fluctuations, he advises being prepared for them. Having a diversified portfolio and a long-term investment strategy can help weather market downturns.

Buffett stresses the importance of staying calm and not making rash decisions during market turbulence.

Give Back

Philanthropy is a significant aspect of Buffett’s financial philosophy. He believes in using wealth to make a positive impact on society. Buffett has pledged to give away the majority of his fortune to charitable causes.

This approach to money management underscores the importance of not only accumulating wealth but also using it to help others and contribute to the greater good.

Buffet’s Pearls of Timeless Wisdom

Warren Buffett’s money management tips offer timeless wisdom for anyone looking to improve their financial health. By following Buffett’s principles, individuals can build a solid foundation for financial success.

Buffett’s principles highlight that financial prosperity is not just about making money, but also about managing it wisely and responsibly.

DISCLAIMER

You should read and understand this disclaimer in its entirety before joining or viewing the website or email/blog list of SmallCapStocks.com (the “Publisher”). The information (collectively the “Advertisement”) disseminated by email, text or other method by the Publisher including this publication is a paid commercial advertisement and should not be relied upon for making an investment decision or any other purpose. The Publisher is engaged in the business of marketing and advertising the securities of publicly traded companies in exchange for compensation. The track record, gains, upside, and/or losses mentioned in the Advertisement, if any, should not be considered as true or accurate or be the basis for an investment. The Publisher does not verify the accuracy or completeness of any information included in the Advertisement. While the Publisher does not charge for the SMS service, standard carrier message and data rates may apply. To unsubscribe from receiving promotional text messages to your phone sent via an autodialer, using your phone reply to the sender’s phone number with the word STOP or HELP for help.

The Advertisement is not a solicitation or recommendation to buy securities of the advertised company. An offer to buy or sell securities can be made only by a disclosure document that complies with applicable securities laws and only in the states or other jurisdictions in which the security is eligible for sale. The Advertisement is not a disclosure document. The Advertisement is only a favorable snapshot of unverified information about the advertised company. An investor considering purchasing the securities, should always do so only with the assistance of his legal, tax and investment advisors. Investors should review with his or her investment advisor, tax advisor or attorney, if and to the extent available, any information concerning a potential investment at the web sites of the U.S. Securities and Exchange Commission (the "SEC") at www.sec.gov; the Financial Industry Regulatory Authority (the "FINRA") at www.FINRA.org, and relevant State Securities Administrator website and the OTC Markets website at www.otcmarkets.com. The Publisher cautions investors to read the SEC advisory to investors concerning Internet Stock Fraud at www.sec.gov/consumer/cyberfr.htm, as well as related information published by the FINRA on how to invest carefully. Investors are responsible for verifying all information in the Advertisement. As an advertiser, we do not verify any information we publish. The Advertisement should not be considered true or complete.

The Publisher does not offer investment advice or analysis, and the Publisher further urges you to consult your own independent tax, business, financial and investment advisors concerning any investment you make in securities particularly those quoted on the OTC Markets. Investing in securities is highly speculative and carries an extremely high degree of risk. You could lose your entire investment if you invest in any company mentioned in the Advertisement. You acknowledge that we are not an investment advisory service, a broker-dealer or an investment adviser and we are not qualified to act as such. You acknowledge that you will consult with your own independent, tax, financial and/or legal advisers regarding any decisions as to any company mentioned here. We have not determined if the Advertisement is accurate, correct or truthful. The Advertisement is compiled from publicly available information, which include, but are not limited to, no cost online research, magazines, newspapers, reports filed with the SEC or information furnished by way of press releases. Because all information relied upon by us in preparing an advertisement about an issuer comes from a public source, it is not reliable, and you should not assume it is accurate or complete.

By your subscription to our profiles, the viewing of this profile and/or use of our website, you have agreed and acknowledged the terms of our full disclaimer and privacy policy which can be viewed at the following link: www.SmallCapStocks.com/Disclaimer and www.SmallCapStocks.com/Privacy-Policy

By accepting the Advertisement, you agree and acknowledge that any hyperlinks to the website of (1) a client company, (2) the party issuing or preparing the information for the company, or (3) other information contained in the Advertisement is provided only for your reference and convenience. The advertiser is not responsible for the accuracy or reliability of these external sites, nor is it responsible for the content, opinions, products or other materials on external sites or information sources. If you use, act upon or make decisions in reliance on information contained in any disseminated report/release or any hyperlink, you do so at your own risk and agree to hold us, our officers, directors, shareholders, affiliates and agents harmless. You acknowledge that you are not relying on the Publisher, and we are not liable for, any actions taken by you based on any information contained in any disseminated email or hyperlink.

I’m Nathan Goldstein, a writer and political analyst focused on simplifying complex social and political issues. My writing breaks down the intricacies of today’s society and politics to make them more understandable for you. I’m committed to providing clear and well-informed insights.