- The Marcus Corporation’s stock has fallen by almost 30% Year-to-Date, reaching a level last seen during the COVID-19 pandemic.

- The company’s real estate assets are undervalued by the market, estimated to be worth $15 per share.

- However, there are no catalysts in sight to unlock the value of the real estate assets.

- Investors will likely have to wait until 2025, when a better film slate will likely improve sentiment towards the sector.

Marcus Corporation stock has dropped significantly, but without triggers to realize its value, a bullish trend may not happen until 2025, when the film industry potentially improves. Investors will need to exercise patience as the current environment offers little hope for immediate gains.

Company Overview

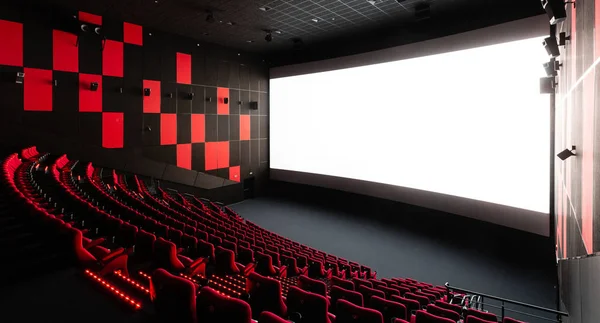

Founded in 1935, The Marcus Corporation operates both movie theatres and hotels. Marcus Theatres is the fourth-largest movie exhibitor in the U.S., with 993 screens in 17 states, while Marcus Hotels & Resorts manages 16 high-end properties.

The company’s business mix has shifted post-COVID, with revenues now split more evenly between theatres and hotels, but earnings remain under pressure due to weaker theatre attendance.

The New Normal in Movie Attendance

Movie attendance has stabilized at approximately 80% of pre-pandemic levels. The rise of video streaming services and lingering public health concerns suggest this is the new normal, affecting earnings potential.

Revenge Travel Supports Hotels

Despite struggles in the theatre segment, MCS’s hotel business has benefited from ‘revenge travel,’ pushing industry revenues above 2019 levels. However, this hasn’t fully offset the theatre business’s decline, with overall revenues at 89% of 2019 levels and operating income significantly lower.

Q1 Performance and 2024 Outlook

MCS’s Q1 fiscal results were disappointing, with revenues down 9.1% year-over-year and an increased operating loss. The weak performance was attributed to a poor film slate caused by Hollywood labor strikes.

The 2024 box office is also tracking significantly below the previous year, casting doubt on a recovery in the near term.

Valuation Underpinned by Real Estate

MCS’s real estate, particularly its ownership of theatre and hotel properties, underpins its valuation.

The company owns 2,406 hotel rooms and 993 theatre screens, with estimated values of $385 million and $794 million, respectively. Combined, these assets are estimated to be worth about $1.2 billion, or $15 per share.

However, the high-interest rate environment has stymied real estate transactions, limiting potential unlock value.

Convertible Bonds and Valuation Impact

MCS has $100 million in convertible notes due in September 2025, converting to equity at $11.01 per share. This impacts the valuation, potentially diluting shares if converted, but also supporting the company’s balance sheet during tough times.

Shares are Undervalued

Marcus Corporation’s shares are undervalued based on its real estate assets, but without immediate catalysts, the stock is unlikely to see significant appreciation until at least 2025.

Investors must be patient as the current environment, including weak theatre attendance and frozen real estate markets, offers little immediate upside. Thus, maintaining a hold rating is prudent given the circumstances.

DISCLAIMER

You should read and understand this disclaimer in its entirety before joining or viewing the website or email/blog list of SmallCapStocks.com (the “Publisher”). The information (collectively the “Advertisement”) disseminated by email, text or other method by the Publisher including this publication is a paid commercial advertisement and should not be relied upon for making an investment decision or any other purpose. The Publisher is engaged in the business of marketing and advertising the securities of publicly traded companies in exchange for compensation. The track record, gains, upside, and/or losses mentioned in the Advertisement, if any, should not be considered as true or accurate or be the basis for an investment. The Publisher does not verify the accuracy or completeness of any information included in the Advertisement. While the Publisher does not charge for the SMS service, standard carrier message and data rates may apply. To unsubscribe from receiving promotional text messages to your phone sent via an autodialer, using your phone reply to the sender’s phone number with the word STOP or HELP for help.

The Advertisement is not a solicitation or recommendation to buy securities of the advertised company. An offer to buy or sell securities can be made only by a disclosure document that complies with applicable securities laws and only in the states or other jurisdictions in which the security is eligible for sale. The Advertisement is not a disclosure document. The Advertisement is only a favorable snapshot of unverified information about the advertised company. An investor considering purchasing the securities, should always do so only with the assistance of his legal, tax and investment advisors. Investors should review with his or her investment advisor, tax advisor or attorney, if and to the extent available, any information concerning a potential investment at the web sites of the U.S. Securities and Exchange Commission (the "SEC") at www.sec.gov; the Financial Industry Regulatory Authority (the "FINRA") at www.FINRA.org, and relevant State Securities Administrator website and the OTC Markets website at www.otcmarkets.com. The Publisher cautions investors to read the SEC advisory to investors concerning Internet Stock Fraud at www.sec.gov/consumer/cyberfr.htm, as well as related information published by the FINRA on how to invest carefully. Investors are responsible for verifying all information in the Advertisement. As an advertiser, we do not verify any information we publish. The Advertisement should not be considered true or complete.

The Publisher does not offer investment advice or analysis, and the Publisher further urges you to consult your own independent tax, business, financial and investment advisors concerning any investment you make in securities particularly those quoted on the OTC Markets. Investing in securities is highly speculative and carries an extremely high degree of risk. You could lose your entire investment if you invest in any company mentioned in the Advertisement. You acknowledge that we are not an investment advisory service, a broker-dealer or an investment adviser and we are not qualified to act as such. You acknowledge that you will consult with your own independent, tax, financial and/or legal advisers regarding any decisions as to any company mentioned here. We have not determined if the Advertisement is accurate, correct or truthful. The Advertisement is compiled from publicly available information, which include, but are not limited to, no cost online research, magazines, newspapers, reports filed with the SEC or information furnished by way of press releases. Because all information relied upon by us in preparing an advertisement about an issuer comes from a public source, it is not reliable, and you should not assume it is accurate or complete.

By your subscription to our profiles, the viewing of this profile and/or use of our website, you have agreed and acknowledged the terms of our full disclaimer and privacy policy which can be viewed at the following link: www.SmallCapStocks.com/Disclaimer and www.SmallCapStocks.com/Privacy-Policy

By accepting the Advertisement, you agree and acknowledge that any hyperlinks to the website of (1) a client company, (2) the party issuing or preparing the information for the company, or (3) other information contained in the Advertisement is provided only for your reference and convenience. The advertiser is not responsible for the accuracy or reliability of these external sites, nor is it responsible for the content, opinions, products or other materials on external sites or information sources. If you use, act upon or make decisions in reliance on information contained in any disseminated report/release or any hyperlink, you do so at your own risk and agree to hold us, our officers, directors, shareholders, affiliates and agents harmless. You acknowledge that you are not relying on the Publisher, and we are not liable for, any actions taken by you based on any information contained in any disseminated email or hyperlink.

Kevin is an experienced business development strategist and content writer specializing in finance and stock market topics. He has a proven track record of driving sales and enhancing communications for small businesses by blending academic knowledge with practical experience to create engaging and accurate content.