In today’s world, managing finances efficiently is essential for achieving financial stability and reaching long-term goals.

One effective way to improve your financial situation is by identifying areas where you can cut back on spending. By making small adjustments to your spending habits, you can free up more money to save, invest, or pay off debt.

Here are some places where you can consider cutting back on spending.

Dining Out

Eating out at restaurants can be a significant expense, especially if you do it frequently. Consider reducing the number of times you eat out each month and opt for home-cooked meals instead.

Not only is cooking at home generally cheaper, but it also allows you to have more control over the ingredients and portion sizes, leading to potential health benefits as well.

Subscription Services

Subscription services for streaming platforms, magazines, or gym memberships can add up quickly, especially if you’re not using them regularly. Take some time to review your subscriptions and consider canceling those that you don’t fully utilize.

Alternatively, look for more affordable alternatives or consider sharing subscriptions with family or friends to split the cost.

Entertainment

While it’s essential to have fun and relax, entertainment expenses like movie tickets, concerts, or recreational activities can eat into your budget. Look for free or low-cost alternatives, such as community events, outdoor activities, or exploring local parks and attractions. Additionally, consider setting a monthly entertainment budget to avoid overspending.

Transportation

Transportation costs, including fuel, public transportation fares, or ride-sharing services, can take a significant portion of your budget. Explore ways to reduce these expenses, such as carpooling, biking, or using public transportation more frequently.

If possible, consider downsizing to a more fuel-efficient vehicle or eliminating unnecessary trips to save on fuel costs.

Shopping Habits

Impulse purchases and unnecessary shopping can quickly drain your finances. Before making a purchase, especially for non-essential items, ask yourself if it’s something you truly need or if it’s just a want.

Consider implementing a waiting period before buying to avoid impulse purchases and take advantage of sales, discounts, or coupons to save money on essential purchases.

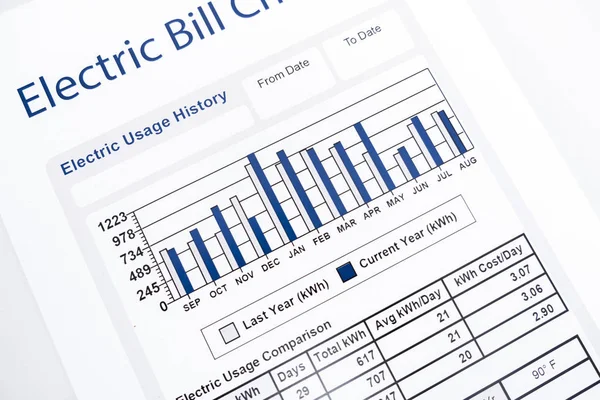

Utilities

Utilities like electricity, water, and heating can contribute to high monthly expenses. Take steps to reduce your energy consumption, such as turning off lights and appliances when not in use, using energy-efficient light bulbs, or installing programmable thermostats to regulate heating and cooling.

Additionally, consider shopping around for better deals on utilities or negotiating with your providers for lower rates.

Dining and Coffee Habits

Regularly grabbing coffee or snacks from cafes or restaurants can add up over time. Instead of buying coffee or meals on the go, consider brewing your coffee at home and packing lunches or snacks for work or outings.

Not only will this save you money, but it will also allow you to make healthier choices and reduce unnecessary packaging waste.

Banking Fees

Banking fees, including ATM fees, overdraft fees, or account maintenance fees, can eat into your savings without you even realizing it.

Choose a bank or credit union that offers fee-free checking accounts or consider switching to online banks that often have lower fees and higher interest rates on savings accounts.

Additionally, be mindful of your account balances and avoid overdrafts by monitoring your spending closely.

Cut Back on Spending

Identifying areas where you can cut back on spending is an essential step toward improving your financial well-being.

By making small changes to your spending habits and prioritizing your financial goals, you can build a stronger financial foundation for the future.

DISCLAIMER

You should read and understand this disclaimer in its entirety before joining or viewing the website or email/blog list of SmallCapStocks.com (the “Publisher”). The information (collectively the “Advertisement”) disseminated by email, text or other method by the Publisher including this publication is a paid commercial advertisement and should not be relied upon for making an investment decision or any other purpose. The Publisher is engaged in the business of marketing and advertising the securities of publicly traded companies in exchange for compensation. The track record, gains, upside, and/or losses mentioned in the Advertisement, if any, should not be considered as true or accurate or be the basis for an investment. The Publisher does not verify the accuracy or completeness of any information included in the Advertisement. While the Publisher does not charge for the SMS service, standard carrier message and data rates may apply. To unsubscribe from receiving promotional text messages to your phone sent via an autodialer, using your phone reply to the sender’s phone number with the word STOP or HELP for help.

The Advertisement is not a solicitation or recommendation to buy securities of the advertised company. An offer to buy or sell securities can be made only by a disclosure document that complies with applicable securities laws and only in the states or other jurisdictions in which the security is eligible for sale. The Advertisement is not a disclosure document. The Advertisement is only a favorable snapshot of unverified information about the advertised company. An investor considering purchasing the securities, should always do so only with the assistance of his legal, tax and investment advisors. Investors should review with his or her investment advisor, tax advisor or attorney, if and to the extent available, any information concerning a potential investment at the web sites of the U.S. Securities and Exchange Commission (the "SEC") at www.sec.gov; the Financial Industry Regulatory Authority (the "FINRA") at www.FINRA.org, and relevant State Securities Administrator website and the OTC Markets website at www.otcmarkets.com. The Publisher cautions investors to read the SEC advisory to investors concerning Internet Stock Fraud at www.sec.gov/consumer/cyberfr.htm, as well as related information published by the FINRA on how to invest carefully. Investors are responsible for verifying all information in the Advertisement. As an advertiser, we do not verify any information we publish. The Advertisement should not be considered true or complete.

The Publisher does not offer investment advice or analysis, and the Publisher further urges you to consult your own independent tax, business, financial and investment advisors concerning any investment you make in securities particularly those quoted on the OTC Markets. Investing in securities is highly speculative and carries an extremely high degree of risk. You could lose your entire investment if you invest in any company mentioned in the Advertisement. You acknowledge that we are not an investment advisory service, a broker-dealer or an investment adviser and we are not qualified to act as such. You acknowledge that you will consult with your own independent, tax, financial and/or legal advisers regarding any decisions as to any company mentioned here. We have not determined if the Advertisement is accurate, correct or truthful. The Advertisement is compiled from publicly available information, which include, but are not limited to, no cost online research, magazines, newspapers, reports filed with the SEC or information furnished by way of press releases. Because all information relied upon by us in preparing an advertisement about an issuer comes from a public source, it is not reliable, and you should not assume it is accurate or complete.

By your subscription to our profiles, the viewing of this profile and/or use of our website, you have agreed and acknowledged the terms of our full disclaimer and privacy policy which can be viewed at the following link: www.SmallCapStocks.com/Disclaimer and www.SmallCapStocks.com/Privacy-Policy

By accepting the Advertisement, you agree and acknowledge that any hyperlinks to the website of (1) a client company, (2) the party issuing or preparing the information for the company, or (3) other information contained in the Advertisement is provided only for your reference and convenience. The advertiser is not responsible for the accuracy or reliability of these external sites, nor is it responsible for the content, opinions, products or other materials on external sites or information sources. If you use, act upon or make decisions in reliance on information contained in any disseminated report/release or any hyperlink, you do so at your own risk and agree to hold us, our officers, directors, shareholders, affiliates and agents harmless. You acknowledge that you are not relying on the Publisher, and we are not liable for, any actions taken by you based on any information contained in any disseminated email or hyperlink.

Joel Gbolade is a seasoned financial writer with over seven years of experience in freelance content creation. Specializing in the financial niche and stock market, he has crafted engaging content for numerous websites. His background in technology extends to data processing and computer proficiency, enriching his comprehensive skill set in the financial realm.