Deciphering the Patterns of Market Movements

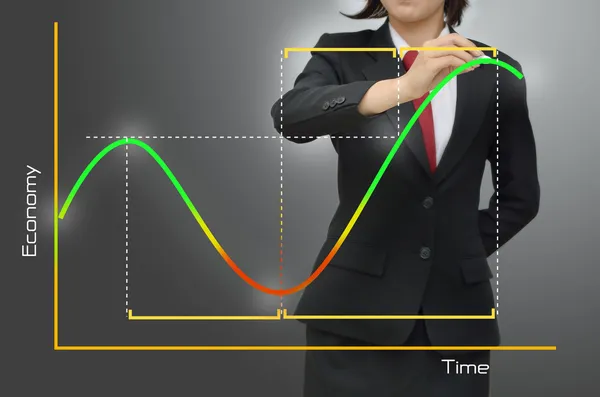

The stock market is often viewed as a complex and unpredictable entity, but beneath its surface lies a pattern of cycles that have intrigued and baffled investors for decades.

Understanding these cycles is crucial for anyone looking to navigate the stock market successfully. If these patterns can be better understood, it can help us better predict how the Stock Market may respond under certain circumstances.

This article aims to shed light on these patterns, offering insights into the rhythmic ebb and flow of market movements.

The Concept of Market Cycles

Market cycles refer to the long-term price patterns of stocks or the stock market as a whole. These cycles are characterized by periods of rising markets (bull markets) followed by periods of declining markets (bear markets).

Each cycle can last from several months to several years and is influenced by a range of economic, political, and psychological factors.

Read More: 5 Biotech Stocks Worth Adding to Your Watchlist

Types of Market Cycles

Secular Cycles

These are long-term trends that last for 5 to 25 years and encompass several shorter-term cyclical trends. Secular cycles can be bullish or bearish and are often driven by overarching economic trends.

Cyclical Cycles

Cyclical cycles, or business cycles, typically last from one to a few years and are closely tied to the health of the economy. They include periods of expansion followed by recession.

Seasonal and Calendar Effects

Shorter in nature, these cycles include phenomena like the January effect, where stocks often perform better at the beginning of the year, or the sell-in-May-and-go-away trend.

Drivers of Market Cycles

However, what are the driving factors behind these cycles?

There are several factors that drive these cycles. We will cover some of these below:

Economic Factors

Inflation, interest rates, and economic growth are potent influencers of market cycles. A robust economy usually boosts market confidence, leading to bull markets, whereas economic downturns often trigger bear markets and a less optimistic view of the market.

Political Events

Elections, regulatory changes, and geopolitical tensions can create uncertainty or optimism in the market, influencing its direction. The Stock Market does not like unpredictability, and therefore, uncertainty and tension tend to drag markets down.

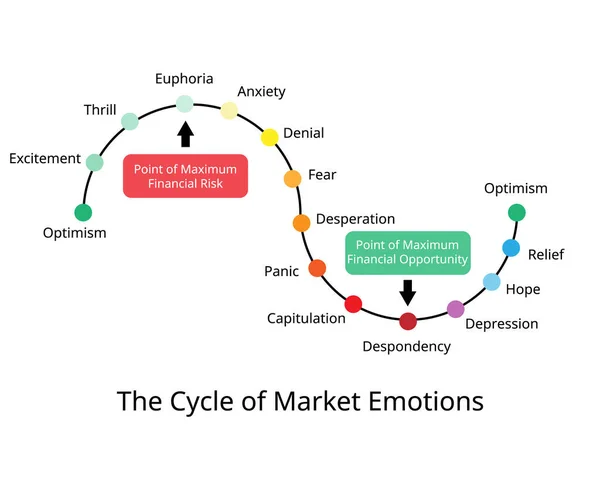

Psychological Factors

Investor sentiment, which includes emotions like fear and greed, plays a significant role in market movements. Often, market peaks and troughs are exaggerated by investor psychology.

Also Read: 3 Banking stocks that may be a buy right now

Technological and Societal Changes

Innovation and societal shifts can lead to the emergence of new sectors and the decline of old ones, impacting market cycles. An industry or sector which performed well in the past may not necessarily perform well in the future.

Historical Perspectives on Market Cycles

Historically, market cycles have been a subject of study and fascination. From the tulip mania in the 1600s to the dot-com bubble and the 2008 financial crisis, history is replete with examples of how market cycles have unfolded, offering valuable lessons for today’s investors.

Strategies for Navigating Market Cycles

Understanding market cycles allows investors to adapt their strategies accordingly. Here are some strategies:

Long-Term Investing

Adopting a long-term view can help investors ride out the volatility of market cycles.

Market Timing

While controversial and risky, some investors attempt to time the market, buying low during bear markets and selling high in bull markets.

Diversification

Spreading investments across various asset classes can reduce risk and offer protection against market cycle volatility.

Trend Watching

Keeping an eye on economic indicators and market trends can provide clues about the current phase of a market cycle.

The Challenge of Predicting Market Cycles

While understanding market cycles is beneficial, predicting them accurately is extremely challenging. Economic conditions, global events, and investor behavior are often unpredictable, making it difficult to pinpoint when a cycle will change.

Conclusion: Embracing the Cyclical Nature of the Stock Market

The stock market’s cycles are a fundamental aspect of its nature. While they can be complex and challenging to predict, a basic understanding of these cycles is essential for investors.

By recognizing the patterns and adapting investment strategies accordingly, investors can be better prepared to navigate the ups and downs of the market.

Ultimately, the key is not to predict the market’s movements with precision but to understand its rhythms and plan for various scenarios.

Read Next: 5 Robotic Stocks to keep an eye on in 2024

DISCLAIMER

You should read and understand this disclaimer in its entirety before joining or viewing the website or email/blog list of SmallCapStocks.com (the “Publisher”). The information (collectively the “Advertisement”) disseminated by email, text or other method by the Publisher including this publication is a paid commercial advertisement and should not be relied upon for making an investment decision or any other purpose. The Publisher is engaged in the business of marketing and advertising the securities of publicly traded companies in exchange for compensation. The track record, gains, upside, and/or losses mentioned in the Advertisement, if any, should not be considered as true or accurate or be the basis for an investment. The Publisher does not verify the accuracy or completeness of any information included in the Advertisement. While the Publisher does not charge for the SMS service, standard carrier message and data rates may apply. To unsubscribe from receiving promotional text messages to your phone sent via an autodialer, using your phone reply to the sender’s phone number with the word STOP or HELP for help.

The Advertisement is not a solicitation or recommendation to buy securities of the advertised company. An offer to buy or sell securities can be made only by a disclosure document that complies with applicable securities laws and only in the states or other jurisdictions in which the security is eligible for sale. The Advertisement is not a disclosure document. The Advertisement is only a favorable snapshot of unverified information about the advertised company. An investor considering purchasing the securities, should always do so only with the assistance of his legal, tax and investment advisors. Investors should review with his or her investment advisor, tax advisor or attorney, if and to the extent available, any information concerning a potential investment at the web sites of the U.S. Securities and Exchange Commission (the “SEC”) at www.sec.gov; the Financial Industry Regulatory Authority (the “FINRA”) at www.FINRA.org, and relevant State Securities Administrator website and the OTC Markets website at www.otcmarkets.com. The Publisher cautions investors to read the SEC advisory to investors concerning Internet Stock Fraud at www.sec.gov/consumer/cyberfr.htm, as well as related information published by the FINRA on how to invest carefully. Investors are responsible for verifying all information in the Advertisement. As an advertiser, we do not verify any information we publish. The Advertisement should not be considered true or complete.

The Publisher does not offer investment advice or analysis, and the Publisher further urges you to consult your own independent tax, business, financial and investment advisors concerning any investment you make in securities particularly those quoted on the OTC Markets. Investing in securities is highly speculative and carries an extremely high degree of risk. You could lose your entire investment if you invest in any company mentioned in the Advertisement. You acknowledge that we are not an investment advisory service, a broker-dealer or an investment adviser and we are not qualified to act as such. You acknowledge that you will consult with your own independent, tax, financial and/or legal advisers regarding any decisions as to any company mentioned here. We have not determined if the Advertisement is accurate, correct or truthful. The Advertisement is compiled from publicly available information, which include, but are not limited to, no cost online research, magazines, newspapers, reports filed with the SEC or information furnished by way of press releases. Because all information relied upon by us in preparing an advertisement about an issuer comes from a public source, it is not reliable, and you should not assume it is accurate or complete.

By your subscription to our profiles, the viewing of this profile and/or use of our website, you have agreed and acknowledged the terms of our full disclaimer and privacy policy which can be viewed at the following link:

www.SmallCapStocks.com/Disclaimer and www.SmallCapStocks.com/Privacy-Policy

By accepting the Advertisement, you agree and acknowledge that any hyperlinks to the website of (1) a client company, (2) the party issuing or preparing the information for the company, or (3) other information contained in the Advertisement is provided only for your reference and convenience. The advertiser is not responsible for the accuracy or reliability of these external sites, nor is it responsible for the content, opinions, products or other materials on external sites or information sources. If you use, act upon or make decisions in reliance on information contained in any disseminated report/release or any hyperlink, you do so at your own risk and agree to hold us, our officers, directors, shareholders, affiliates and agents harmless. You acknowledge that you are not relying on the Publisher, and we are not liable for, any actions taken by you based on any information contained in any disseminated email or hyperlink.

I’m Elizabeth Monroe, a writer who brings you stories from around the world. I’m passionate about sharing important global news and amplifying the voices of those often left unheard. Through my writing, I aim to make the world feel a bit closer and more accessible.