Strategic Advances and Financial Health

Pacific Biosciences (PacBio) is demonstrating its prowess in the rapidly evolving genomics sector, showcasing not only financial growth but also significant technological advancements.

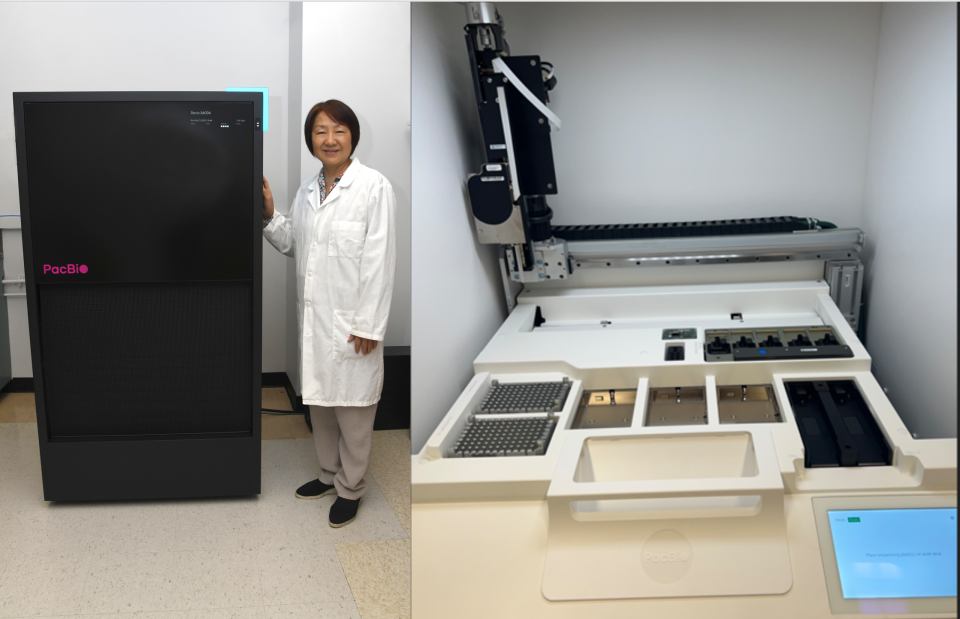

The introduction of the Revio system and the precision of the Onso in short-read applications mark substantial strides in genomics research, equipping PacBio to offer more than mere products but a gateway to deeper genomic exploration.

The forecasted CAGR of 40-50% over the next two years underscores a robust market strategy and positioning.

Read More: China’s Producer Prices Dip for 16th Straight Month

2023 Financial Outlook

PacBio’s financial landscape for 2023 reflects a dynamic growth trajectory, with preliminary unaudited revenue for Q4 reaching $58.4 million, doubling the previous year’s same-quarter revenue.

This growth extends to a 56% increase in annual revenue, totaling $200.5 million, a commendable feat amidst a competitive genomics landscape and economic uncertainties.

Revenue Composition and Market Acceptance

The surge in instrument sales, growing sixfold year-over-year in Q4, signifies the market’s endorsement of PacBio’s technologies. Meanwhile, consumables provide a steady revenue stream, with services and support maintaining consistent levels, indicative of sustained customer engagement.

Capital Strength and Growth Projections

PacBio’s substantial cash reserves of over $631 million underscore its financial prudence and readiness to fuel R&D, expand market presence, and navigate potential downturns.

The commitment to a 40-50% revenue growth rate until 2026, aiming to surpass $500 million, reflects a calculated yet ambitious growth path.

Product Innovation and Market Expansion

2023 has seen PacBio diversify its product portfolio, enhancing its market share through the Revio system and Onso sequencer. These innovations, coupled with the adoption of HiFi technology and the launch of new software and kits, position PacBio as a leader in genomics research.

Also Read: China’s Producer Prices Dip for 16th Straight Month

Market Position and Competitive Landscape

PacBio’s strategic focus on consumables and service offerings, alongside a growing installed base of sequencing systems, lays a foundation for recurring revenue and long-term sustainability.

The company’s advancements in long-read sequencing technologies, supported by strategic investments, carve a niche in the competitive genomics market.

Valuation and Market Perception

Despite PacBio’s premium valuation in the market, with EV/SALES and Price/Sales ratios exceeding sector medians, its unique positioning and innovative solutions justify the market optimism.

The company’s strategic endeavors in genomics sequencing, particularly in human genomics and oncology, present significant growth opportunities.

Genomics Market Dynamics

The genomics market, with its vast applications across healthcare, agriculture, and research, presents a multi-billion dollar opportunity. Companies like PacBio, Illumina, and Oxford Nanopore Technologies are pivotal in driving scientific and medical advancements, with each bringing unique technological strengths to the table.

Technological and Market Challenges

While PacBio’s HiFi sequencing technology sets it apart for its accuracy in long-read sequencing, the company navigates a market characterized by rapid technological advancements and shifting customer needs.

The success of PacBio’s ambitious growth targets hinges on continuous innovation, effective market strategies, and adaptability to regulatory and market shifts.

Investor Considerations

For investors, PacBio represents a compelling case within the biotech sector, offering potential for long-term growth amid the expanding applications of genomics.

However, the inherent risks of the biotech industry, including technological obsolescence, market competition, and regulatory hurdles, necessitate a balanced view of PacBio’s promising outlook against potential challenges.

Read Next: Spirit Airlines Say They Are on The Path to Profitability as They Narrow Their Losses

DISCLAIMER

You should read and understand this disclaimer in its entirety before joining or viewing the website or email/blog list of SmallCapStocks.com (the “Publisher”). The information (collectively the “Advertisement”) disseminated by email, text or other method by the Publisher including this publication is a paid commercial advertisement and should not be relied upon for making an investment decision or any other purpose. The Publisher is engaged in the business of marketing and advertising the securities of publicly traded companies in exchange for compensation. The track record, gains, upside, and/or losses mentioned in the Advertisement, if any, should not be considered as true or accurate or be the basis for an investment. The Publisher does not verify the accuracy or completeness of any information included in the Advertisement. While the Publisher does not charge for the SMS service, standard carrier message and data rates may apply. To unsubscribe from receiving promotional text messages to your phone sent via an autodialer, using your phone reply to the sender’s phone number with the word STOP or HELP for help.

The Advertisement is not a solicitation or recommendation to buy securities of the advertised company. An offer to buy or sell securities can be made only by a disclosure document that complies with applicable securities laws and only in the states or other jurisdictions in which the security is eligible for sale. The Advertisement is not a disclosure document. The Advertisement is only a favorable snapshot of unverified information about the advertised company. An investor considering purchasing the securities, should always do so only with the assistance of his legal, tax and investment advisors. Investors should review with his or her investment advisor, tax advisor or attorney, if and to the extent available, any information concerning a potential investment at the web sites of the U.S. Securities and Exchange Commission (the "SEC") at www.sec.gov; the Financial Industry Regulatory Authority (the "FINRA") at www.FINRA.org, and relevant State Securities Administrator website and the OTC Markets website at www.otcmarkets.com. The Publisher cautions investors to read the SEC advisory to investors concerning Internet Stock Fraud at www.sec.gov/consumer/cyberfr.htm, as well as related information published by the FINRA on how to invest carefully. Investors are responsible for verifying all information in the Advertisement. As an advertiser, we do not verify any information we publish. The Advertisement should not be considered true or complete.

The Publisher does not offer investment advice or analysis, and the Publisher further urges you to consult your own independent tax, business, financial and investment advisors concerning any investment you make in securities particularly those quoted on the OTC Markets. Investing in securities is highly speculative and carries an extremely high degree of risk. You could lose your entire investment if you invest in any company mentioned in the Advertisement. You acknowledge that we are not an investment advisory service, a broker-dealer or an investment adviser and we are not qualified to act as such. You acknowledge that you will consult with your own independent, tax, financial and/or legal advisers regarding any decisions as to any company mentioned here. We have not determined if the Advertisement is accurate, correct or truthful. The Advertisement is compiled from publicly available information, which include, but are not limited to, no cost online research, magazines, newspapers, reports filed with the SEC or information furnished by way of press releases. Because all information relied upon by us in preparing an advertisement about an issuer comes from a public source, it is not reliable, and you should not assume it is accurate or complete.

By your subscription to our profiles, the viewing of this profile and/or use of our website, you have agreed and acknowledged the terms of our full disclaimer and privacy policy which can be viewed at the following link: www.SmallCapStocks.com/Disclaimer and www.SmallCapStocks.com/Privacy-Policy

By accepting the Advertisement, you agree and acknowledge that any hyperlinks to the website of (1) a client company, (2) the party issuing or preparing the information for the company, or (3) other information contained in the Advertisement is provided only for your reference and convenience. The advertiser is not responsible for the accuracy or reliability of these external sites, nor is it responsible for the content, opinions, products or other materials on external sites or information sources. If you use, act upon or make decisions in reliance on information contained in any disseminated report/release or any hyperlink, you do so at your own risk and agree to hold us, our officers, directors, shareholders, affiliates and agents harmless. You acknowledge that you are not relying on the Publisher, and we are not liable for, any actions taken by you based on any information contained in any disseminated email or hyperlink.

I’m Elizabeth Monroe, a writer who brings you stories from around the world. I’m passionate about sharing important global news and amplifying the voices of those often left unheard. Through my writing, I aim to make the world feel a bit closer and more accessible.