The story of Sigma Lithium Corporation began in 2012 with the company’s commitment to deliver clean lithium for electrification and technological battery material. The company’s share price has declined 68.37% year-over-year due to volatile lithium prices.

As of May 2024, the price of metric tons of lithium carbonate and lithium hydroxide stood at $14,250, a decline of 81.8% and 83.2%, respectively. November 2022 had seen both compounds reach peaks of $78,200 per metric ton and $84,700 per metric ton.

In this article, we explore why SGML may be a prudent investment as it seeks to support its valuation pending a potential sale of the company. The company intends to raise its production capacity through 2024, anticipating a rebound in lithium prices.

Stable Quarter and Capacity Expansion

Sigma Lithium released its Q1 2024 financial report in May, indicating flat revenues of $37.2 million, almost at par with Q4 2023 revenues of $37.688 million. Despite the 1.29% quarter-over-quarter decline in revenues, Sigma recorded a 20.75% increase in the average reported selling price per ton of lithium.

This rise occurred despite the 18.27% quarter-over-quarter decline in the amount of concentrate sold in Q1 2024.

The company confirmed that it is in the process of commencing infrastructural builds in H2 2024 to increase its concentrate production. For instance, the “Quintuple Zero Green Lithium” project is set to rise almost 93% year-over-year to 520,000 tons per year from 270,000 tons per year.

Sigma’s board also approved the Phase 2 project expansion of the Industrial Greentech Plant by 250,000 tons per year. Apart from the $100 million planned capital expense to support this project, the company also explained that it already has the environmental license to support the work.

Sigma Lithium’s CEO Ana Cabral stated, “During 2024, Sigma has delivered on several key milestones aimed at doubling industrial capacity by 2025. We made the final investment decision to initiate construction of a second Greentech plant, and we extended operational life to 25 years at Grota do Cirilo by increasing our audited proven and probable mineral reserve by 40%. Our entire team is focused on the execution of this industrial and mineral capacity expansion, repeating the success of Phase 1 by delivering this second stage of operational growth on time and within budget.”

Sigma Lithium’s Sales Strategy

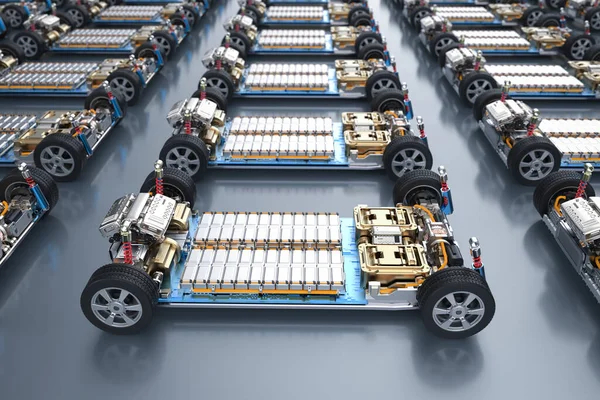

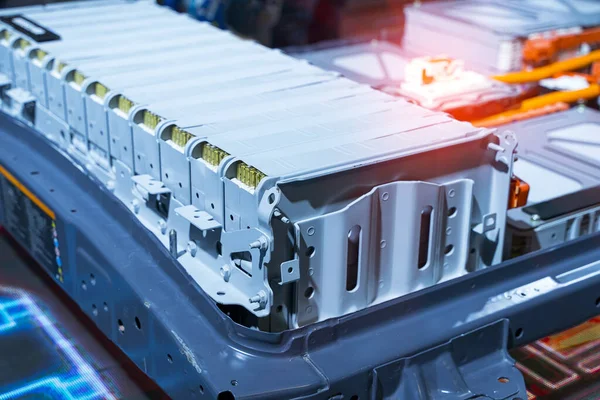

In 2023, Sigma Lithium considered selling the company but has since focused on expansion due to low lithium prices. The pullback in lithium prices was caused by the slower adoption of electric vehicles (EVs), which form the largest client base for the metal.

Despite this, decarbonization efforts and the demand for EVs are expected to grow, with sales of EVs projected to reach up to 17 million in 2024. The demand for lithium is forecasted to reach 2.5 million metric tons by 2030.

Sigma Lithium’s Greentech lithium is marketed as a green resource, enhancing the company’s attractiveness with its zero-carbon plan. The power used in the plant is “100% renewable as well as recycled water and dry-stacked tailings.”

The overall goal of SGML is to enable large-scale production of lithium, driving down the cost of production.

Valuation

SGML is trading slightly above $12 with a market cap of $1.4 billion and has lost almost 70% in the last 12 months. The company’s forward price-to-earnings ratio is 28.07 against the industry average of 16.93, indicating it is likely overvalued. However, the situation may change with an increase in lithium prices.

SGML’s cash balance is also at $108.08 million against a total debt of $204.92 million, bringing its enterprise value (EV) to about $1.50 billion. In its Q1 2024 report, the company reported “35.3% margins on pro forma EBITDA of $17.4 million and 15.8% margins on adjusted EBITDA of $5.9 million.”

The company’s forward EV/EBITDA stands at 13.47 against the industry average of 8.52.

Risk

SGML has $108.08 million in cash and a debt of $204.92 million, presenting a significant risk. The company needs substantial capital for its expansion projects and to meet its debt obligations. The value of the stock may also be suppressed if the company opts for equity financing to raise capital.

Conclusion

Sigma Lithium is a hold, given its re-valuation strategy involving the production and sale of lithium. The company plans to expand its phase 2 project for the Greentech Plant to at least 520,000 tons per annum from 250,000 tons, with a projection to hit a production level of 109 million tons by 2025.

The company’s commitment to using 100% renewable power makes it attractive in the quest for carbon-zero production units. While the sale of the company was previously considered, the current focus on expansion and the potential rebound in lithium prices suggest that holding SGML may be a prudent strategy for investors looking to benefit from future growth.

DISCLAIMER

You should read and understand this disclaimer in its entirety before joining or viewing the website or email/blog list of SmallCapStocks.com (the “Publisher”). The information (collectively the “Advertisement”) disseminated by email, text or other method by the Publisher including this publication is a paid commercial advertisement and should not be relied upon for making an investment decision or any other purpose. The Publisher is engaged in the business of marketing and advertising the securities of publicly traded companies in exchange for compensation. The track record, gains, upside, and/or losses mentioned in the Advertisement, if any, should not be considered as true or accurate or be the basis for an investment. The Publisher does not verify the accuracy or completeness of any information included in the Advertisement. While the Publisher does not charge for the SMS service, standard carrier message and data rates may apply. To unsubscribe from receiving promotional text messages to your phone sent via an autodialer, using your phone reply to the sender’s phone number with the word STOP or HELP for help.

The Advertisement is not a solicitation or recommendation to buy securities of the advertised company. An offer to buy or sell securities can be made only by a disclosure document that complies with applicable securities laws and only in the states or other jurisdictions in which the security is eligible for sale. The Advertisement is not a disclosure document. The Advertisement is only a favorable snapshot of unverified information about the advertised company. An investor considering purchasing the securities, should always do so only with the assistance of his legal, tax and investment advisors. Investors should review with his or her investment advisor, tax advisor or attorney, if and to the extent available, any information concerning a potential investment at the web sites of the U.S. Securities and Exchange Commission (the "SEC") at www.sec.gov; the Financial Industry Regulatory Authority (the "FINRA") at www.FINRA.org, and relevant State Securities Administrator website and the OTC Markets website at www.otcmarkets.com. The Publisher cautions investors to read the SEC advisory to investors concerning Internet Stock Fraud at www.sec.gov/consumer/cyberfr.htm, as well as related information published by the FINRA on how to invest carefully. Investors are responsible for verifying all information in the Advertisement. As an advertiser, we do not verify any information we publish. The Advertisement should not be considered true or complete.

The Publisher does not offer investment advice or analysis, and the Publisher further urges you to consult your own independent tax, business, financial and investment advisors concerning any investment you make in securities particularly those quoted on the OTC Markets. Investing in securities is highly speculative and carries an extremely high degree of risk. You could lose your entire investment if you invest in any company mentioned in the Advertisement. You acknowledge that we are not an investment advisory service, a broker-dealer or an investment adviser and we are not qualified to act as such. You acknowledge that you will consult with your own independent, tax, financial and/or legal advisers regarding any decisions as to any company mentioned here. We have not determined if the Advertisement is accurate, correct or truthful. The Advertisement is compiled from publicly available information, which include, but are not limited to, no cost online research, magazines, newspapers, reports filed with the SEC or information furnished by way of press releases. Because all information relied upon by us in preparing an advertisement about an issuer comes from a public source, it is not reliable, and you should not assume it is accurate or complete.

By your subscription to our profiles, the viewing of this profile and/or use of our website, you have agreed and acknowledged the terms of our full disclaimer and privacy policy which can be viewed at the following link: www.SmallCapStocks.com/Disclaimer and www.SmallCapStocks.com/Privacy-Policy

By accepting the Advertisement, you agree and acknowledge that any hyperlinks to the website of (1) a client company, (2) the party issuing or preparing the information for the company, or (3) other information contained in the Advertisement is provided only for your reference and convenience. The advertiser is not responsible for the accuracy or reliability of these external sites, nor is it responsible for the content, opinions, products or other materials on external sites or information sources. If you use, act upon or make decisions in reliance on information contained in any disseminated report/release or any hyperlink, you do so at your own risk and agree to hold us, our officers, directors, shareholders, affiliates and agents harmless. You acknowledge that you are not relying on the Publisher, and we are not liable for, any actions taken by you based on any information contained in any disseminated email or hyperlink.