Raspberry Pi, a British computing startup known for its tiny single-board computers, saw a significant rise in its share price on Tuesday, reflecting strong investor interest. The company, which aims to make computing accessible to young people, is now seeking to raise £166 million ($211.2 million) from its initial public offering (IPO).

Investment Thesis

Raspberry Pi’s IPO marks a significant milestone, not only for the company but also for the London Stock Exchange, which has struggled to attract high-profile technology listings.

The strong performance of Raspberry Pi shares suggests a promising future, driven by robust revenue growth and increasing adoption in industrial markets.

Investors may find Raspberry Pi an attractive opportunity due to its innovative product range, solid market position, and the potential for further expansion.

Historical Financial Analysis

Raspberry Pi has demonstrated impressive financial growth over the past few years. In 2023, the company posted revenues of $265.8 million, representing a 41% increase from 2022. This growth can be attributed to the rising demand for its single-board computers, particularly in industrial applications.

The company’s ability to consistently increase its revenue highlights its strong market presence and effective business strategy.

Recent Earnings Analysis

In the most recent financial year, Raspberry Pi reported a revenue increase of 41%, bringing total revenues to $265.8 million. This substantial growth underscores the company’s expanding footprint in both consumer and industrial markets.

The successful IPO, with shares rising to 390 pence from an initial price of 280 pence, reflects strong market confidence in Raspberry Pi’s business model and future prospects.

Business Overview and Market Trends

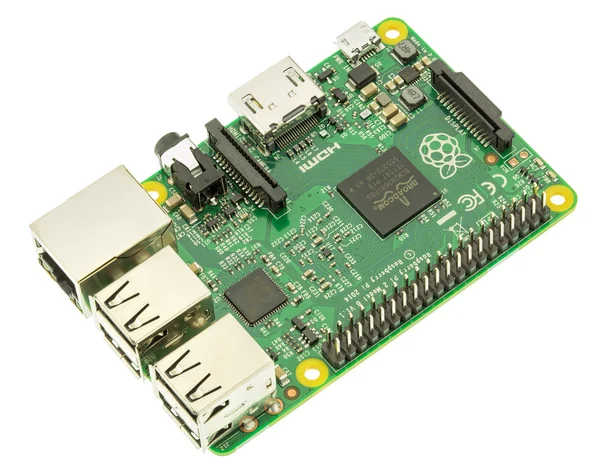

Raspberry Pi was established in 2012 by CEO Eben Upton with the goal of making computing more accessible. Initially popular among hobbyists, the company’s products are now increasingly used in industrial applications.

Currently, 72% of its unit sales are targeted at the industrial market, where its single-board computers are utilized in various settings, including factories.

The tech industry is witnessing a growing trend towards compact and versatile computing solutions, making Raspberry Pi’s offerings highly relevant. Additionally, the company’s backing by high-profile industry players like Arm and Sony further solidifies its position in the market.

Growth Prospects

Raspberry Pi’s growth prospects are bolstered by its innovative product lineup and expanding industrial applications. The IPO proceeds will likely be used to further develop new products and expand market reach.

The company’s strategic focus on the industrial sector, which represents a significant portion of its sales, positions it well for sustained growth.

Moreover, the potential overallotment option, which could raise the final offer size to £178.9 million, indicates strong demand for Raspberry Pi shares. This additional capital could be instrumental in driving further expansion and innovation.

Valuation and Comparative Analysis

Based on the initial pricing of its shares at 280 pence apiece, Raspberry Pi is valued at approximately £541.6 million. This valuation reflects investor confidence in the company’s growth trajectory and market potential.

Comparatively, Raspberry Pi’s valuation seems reasonable given its revenue growth and market position.

The company’s recent performance and strong investor interest set it apart from other tech firms that have opted for listings in other parts of Europe or the U.S. The successful IPO could encourage more tech companies to consider the London Stock Exchange for their listings.

Risks

Despite the positive outlook, Raspberry Pi faces several risks. The competitive nature of the tech industry means that the company must continually innovate to maintain its market position.

Additionally, any disruption in its supply chain or failure to meet market demands could impact its financial performance.

The company’s reliance on the industrial market also exposes it to sector-specific risks, such as economic downturns or changes in industrial technology trends. Furthermore, fluctuations in currency exchange rates could affect its international revenue streams.

Raspberry Pi: A Stock Worth Watching

Raspberry Pi’s successful IPO and strong financial performance make it a compelling investment opportunity. The company’s innovative products, strategic market focus, and robust revenue growth position it well for future success.

While there are risks to consider, the potential rewards make Raspberry Pi a stock worth watching. The IPO could also serve as a catalyst for revitalizing the London Stock Exchange, attracting more tech firms to its listings in the future.

DISCLAIMER

You should read and understand this disclaimer in its entirety before joining or viewing the website or email/blog list of SmallCapStocks.com (the “Publisher”). The information (collectively the “Advertisement”) disseminated by email, text or other method by the Publisher including this publication is a paid commercial advertisement and should not be relied upon for making an investment decision or any other purpose. The Publisher is engaged in the business of marketing and advertising the securities of publicly traded companies in exchange for compensation. The track record, gains, upside, and/or losses mentioned in the Advertisement, if any, should not be considered as true or accurate or be the basis for an investment. The Publisher does not verify the accuracy or completeness of any information included in the Advertisement. While the Publisher does not charge for the SMS service, standard carrier message and data rates may apply. To unsubscribe from receiving promotional text messages to your phone sent via an autodialer, using your phone reply to the sender’s phone number with the word STOP or HELP for help.

The Advertisement is not a solicitation or recommendation to buy securities of the advertised company. An offer to buy or sell securities can be made only by a disclosure document that complies with applicable securities laws and only in the states or other jurisdictions in which the security is eligible for sale. The Advertisement is not a disclosure document. The Advertisement is only a favorable snapshot of unverified information about the advertised company. An investor considering purchasing the securities, should always do so only with the assistance of his legal, tax and investment advisors. Investors should review with his or her investment advisor, tax advisor or attorney, if and to the extent available, any information concerning a potential investment at the web sites of the U.S. Securities and Exchange Commission (the "SEC") at www.sec.gov; the Financial Industry Regulatory Authority (the "FINRA") at www.FINRA.org, and relevant State Securities Administrator website and the OTC Markets website at www.otcmarkets.com. The Publisher cautions investors to read the SEC advisory to investors concerning Internet Stock Fraud at www.sec.gov/consumer/cyberfr.htm, as well as related information published by the FINRA on how to invest carefully. Investors are responsible for verifying all information in the Advertisement. As an advertiser, we do not verify any information we publish. The Advertisement should not be considered true or complete.

The Publisher does not offer investment advice or analysis, and the Publisher further urges you to consult your own independent tax, business, financial and investment advisors concerning any investment you make in securities particularly those quoted on the OTC Markets. Investing in securities is highly speculative and carries an extremely high degree of risk. You could lose your entire investment if you invest in any company mentioned in the Advertisement. You acknowledge that we are not an investment advisory service, a broker-dealer or an investment adviser and we are not qualified to act as such. You acknowledge that you will consult with your own independent, tax, financial and/or legal advisers regarding any decisions as to any company mentioned here. We have not determined if the Advertisement is accurate, correct or truthful. The Advertisement is compiled from publicly available information, which include, but are not limited to, no cost online research, magazines, newspapers, reports filed with the SEC or information furnished by way of press releases. Because all information relied upon by us in preparing an advertisement about an issuer comes from a public source, it is not reliable, and you should not assume it is accurate or complete.

By your subscription to our profiles, the viewing of this profile and/or use of our website, you have agreed and acknowledged the terms of our full disclaimer and privacy policy which can be viewed at the following link: www.SmallCapStocks.com/Disclaimer and www.SmallCapStocks.com/Privacy-Policy

By accepting the Advertisement, you agree and acknowledge that any hyperlinks to the website of (1) a client company, (2) the party issuing or preparing the information for the company, or (3) other information contained in the Advertisement is provided only for your reference and convenience. The advertiser is not responsible for the accuracy or reliability of these external sites, nor is it responsible for the content, opinions, products or other materials on external sites or information sources. If you use, act upon or make decisions in reliance on information contained in any disseminated report/release or any hyperlink, you do so at your own risk and agree to hold us, our officers, directors, shareholders, affiliates and agents harmless. You acknowledge that you are not relying on the Publisher, and we are not liable for, any actions taken by you based on any information contained in any disseminated email or hyperlink.