Leslie’s is a leading provider of products and services for pools and spas. They offer a wide range of items, including chemicals, equipment, and accessories to help maintain and enjoy pools and spas.

Known for their professional services and support to both residential and commercial customers, Leslie’s plays a significant role in the direct-to-consumer retail space within this industry.

Financial Performance

Leslie’s financial performance has been under pressure. Revenue declined from $212.84 million in the quarter ending April 1, 2023, to $188.66 million in the quarter ending March 30, 2024, representing an 11.36% year-over-year decrease. Gross profit fell from $71.17 million to $54.33 million, and gross margin dropped from 33.44% to 28.80%.

This decline was primarily due to unfavorable weather conditions that reduced pool usage and sales in key markets like Texas, Southern California, Arizona, and Florida.

In June 2023, Leslie’s reduced chemical prices to remain competitive, leading to a significant 464 basis points decrease in gross margin. Despite these price adjustments, the company faced lower profits.

Operating income declined from a positive $115.81 million in the quarter ending July 1, 2023, to a negative $30.53 million by March 30, 2024. Adjusted EBITDA for the latest quarter was negative $19 million, reflecting the combined effects of reduced sales and margins.

Increasing competition from mass merchants and specialty retailers is also putting more pressure on Leslie’s future profitability.

In the Q2 2024 earnings call, Leslie’s management highlighted a 23% decrease in inventory levels compared to the previous year. While this reduction in inventory can reduce carrying costs like storage and insurance, it also suggests a cautious outlook on consumer demand and expectations of lower sales volumes due to economic uncertainties and normalizing post-pandemic spending patterns.

This strategy carries risks, as an unexpected surge in demand could leave Leslie’s struggling to meet customer needs, potentially losing sales to better-stocked competitors and straining their supply chain.

Opportunities

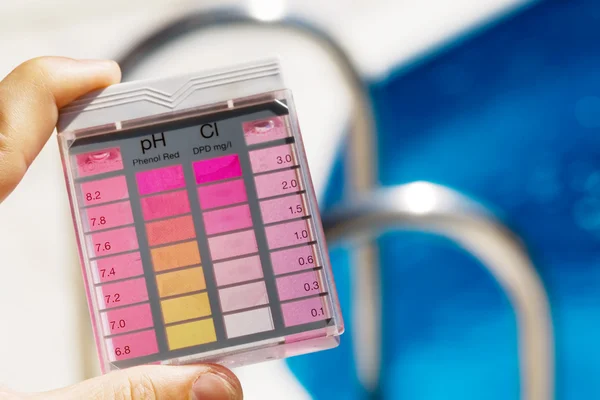

Leslie’s is launching the AccuBlue Home Smart Tech Water Testing Device and Membership Program. This service allows customers to test their pool water at home using the AccuBlue device, providing precise water quality readings.

The membership program includes the device at no cost, with a $50 monthly subscription that is offset by $50 in purchase credits.

This structure encourages regular purchases and has seen significant success, with members spending more than $1,000 per year. This indicates strong customer retention and regular revenue streams, as customers are likely to continue their subscriptions and make regular purchases to maintain their pools.

The AccuBlue program is expected to boost sales and improve customer loyalty by providing a convenient and valuable service.

Leslie’s is also expanding its PRO service locations, aiming to increase the number of PRO contracts and locations. By the end of the second quarter, they had 4,088 PRO contracts and 102 PRO locations, compared to 3,300 PRO contracts and 98 PRO locations at the end of the same quarter last year.

This initiative targets professional pool service providers, driving higher sales volumes and establishing Leslie’s as a go-to supplier for professional-grade products and services. The growth in PRO services shows a stable and growing customer base in the professional segment.

By focusing on the PRO market, Leslie’s can leverage long-term relationships with professional service providers who need consistent large-scale purchases of pool maintenance products and equipment.

This expansion helps stabilize and increase revenue streams, as the professional market often represents repeat and high-volume transactions, contributing significantly to Leslie’s overall sales and profitability.

Challenges

Expanding the PRO service locations comes with obstacles, such as significant investment in infrastructure, staffing, and training. The risk of stretching resources could translate into potential declines in service quality, negatively impacting future revenue.

Additionally, these investments mean large expenditures and high expected revenue growth. However, if expectations are not met, only the expenditure remains.

Growing competition from mass merchants like Walmart and Target, as well as specialty retailers, is putting intense pressure on Leslie’s profitability. These competitors are increasing their product range in the pool and spa care market, making it easier for customers to choose from a wide range of options, including cheaper ones.

Leslie’s could lose market share and see lower profit margins if consumers turn to competitors offering similar products at better prices.

Valuation

Leslie’s current valuation metrics, compared to industry medians, show several aspects of its financial performance and market expectations. Leslie’s gross margin is 38%, which is in line with the industry median. However, the company’s price-to-sales (PS) ratio is 0.72, much higher than the industry median of 0.3.

Leslie’s price-to-earnings (PE) ratio stands at 38.2, markedly higher than the industry median of 6.17. These high ratios indicate overvaluation, especially given the challenges and competitive pressures the company faces.

Despite Leslie’s projected revenue growth of 5% for the next year, above the industry median, the company’s high PS and PE ratios suggest that its stock price might adjust downward to align more closely with its actual growth prospects and competitive position.

Risks and Challenges Remain

Leslie’s innovative initiatives like the AccuBlue Home Smart Tech Water Testing Device and the expansion of PRO service locations show potential. However, the company faces significant obstacles, including weather instability, economic pressures, and increasing competition from mass merchants and specialty retailers.

These challenges create risks to profitability, which may make it difficult for Leslie’s to achieve stable growth and maintain investor confidence in the near term.

DISCLAIMER

You should read and understand this disclaimer in its entirety before joining or viewing the website or email/blog list of SmallCapStocks.com (the “Publisher”). The information (collectively the “Advertisement”) disseminated by email, text or other method by the Publisher including this publication is a paid commercial advertisement and should not be relied upon for making an investment decision or any other purpose. The Publisher is engaged in the business of marketing and advertising the securities of publicly traded companies in exchange for compensation. The track record, gains, upside, and/or losses mentioned in the Advertisement, if any, should not be considered as true or accurate or be the basis for an investment. The Publisher does not verify the accuracy or completeness of any information included in the Advertisement. While the Publisher does not charge for the SMS service, standard carrier message and data rates may apply. To unsubscribe from receiving promotional text messages to your phone sent via an autodialer, using your phone reply to the sender’s phone number with the word STOP or HELP for help.

The Advertisement is not a solicitation or recommendation to buy securities of the advertised company. An offer to buy or sell securities can be made only by a disclosure document that complies with applicable securities laws and only in the states or other jurisdictions in which the security is eligible for sale. The Advertisement is not a disclosure document. The Advertisement is only a favorable snapshot of unverified information about the advertised company. An investor considering purchasing the securities, should always do so only with the assistance of his legal, tax and investment advisors. Investors should review with his or her investment advisor, tax advisor or attorney, if and to the extent available, any information concerning a potential investment at the web sites of the U.S. Securities and Exchange Commission (the "SEC") at www.sec.gov; the Financial Industry Regulatory Authority (the "FINRA") at www.FINRA.org, and relevant State Securities Administrator website and the OTC Markets website at www.otcmarkets.com. The Publisher cautions investors to read the SEC advisory to investors concerning Internet Stock Fraud at www.sec.gov/consumer/cyberfr.htm, as well as related information published by the FINRA on how to invest carefully. Investors are responsible for verifying all information in the Advertisement. As an advertiser, we do not verify any information we publish. The Advertisement should not be considered true or complete.

The Publisher does not offer investment advice or analysis, and the Publisher further urges you to consult your own independent tax, business, financial and investment advisors concerning any investment you make in securities particularly those quoted on the OTC Markets. Investing in securities is highly speculative and carries an extremely high degree of risk. You could lose your entire investment if you invest in any company mentioned in the Advertisement. You acknowledge that we are not an investment advisory service, a broker-dealer or an investment adviser and we are not qualified to act as such. You acknowledge that you will consult with your own independent, tax, financial and/or legal advisers regarding any decisions as to any company mentioned here. We have not determined if the Advertisement is accurate, correct or truthful. The Advertisement is compiled from publicly available information, which include, but are not limited to, no cost online research, magazines, newspapers, reports filed with the SEC or information furnished by way of press releases. Because all information relied upon by us in preparing an advertisement about an issuer comes from a public source, it is not reliable, and you should not assume it is accurate or complete.

By your subscription to our profiles, the viewing of this profile and/or use of our website, you have agreed and acknowledged the terms of our full disclaimer and privacy policy which can be viewed at the following link: www.SmallCapStocks.com/Disclaimer and www.SmallCapStocks.com/Privacy-Policy

By accepting the Advertisement, you agree and acknowledge that any hyperlinks to the website of (1) a client company, (2) the party issuing or preparing the information for the company, or (3) other information contained in the Advertisement is provided only for your reference and convenience. The advertiser is not responsible for the accuracy or reliability of these external sites, nor is it responsible for the content, opinions, products or other materials on external sites or information sources. If you use, act upon or make decisions in reliance on information contained in any disseminated report/release or any hyperlink, you do so at your own risk and agree to hold us, our officers, directors, shareholders, affiliates and agents harmless. You acknowledge that you are not relying on the Publisher, and we are not liable for, any actions taken by you based on any information contained in any disseminated email or hyperlink.

Joel Gbolade is a seasoned financial writer with over seven years of experience in freelance content creation. Specializing in the financial niche and stock market, he has crafted engaging content for numerous websites. His background in technology extends to data processing and computer proficiency, enriching his comprehensive skill set in the financial realm.