When is the best time to start building a retirement portfolio? The answer is immediately – without delay!

It’s widely advised to invest approximately 10 times your yearly income by retirement age. Falling short of this benchmark could result in a decrease in your standard of living during your golden years.

Read More: How to Diversify Your Portfolio with Alternative Investments

Percentage Allocation for Retirement

One of the most dependable methods to achieve this goal is by allocating 15% of your income to an investment portfolio throughout your working career. Yet, maintaining a 15% contribution rate might pose a significant challenge if you’re currently on a tight budget or grappling with debt.

Nevertheless, it’s imperative to prioritize retirement savings promptly. The funds you invest now have the potential to double approximately every decade. Delaying your start diminishes the number of opportunities for your wealth to multiply.

If your current financial situation doesn’t accommodate retirement investing, it’s time to make adjustments. Consider scaling back your lifestyle to free up funds. Additionally, focus on swiftly reducing any high-interest debts and begin directing modest contributions towards retirement accounts.

Once you’ve cleared your debts, incrementally increase your retirement contributions, seizing every opportunity to do so with each pay raise.

Types of Investments for Retirement Portfolios

Your retirement contributions will fund an investment portfolio—that is, a collection of assets you expect to grow in value over time.

For most retirement savers, the assets are stocks, bonds, and mutual funds. You invest in these securities while you’re earning a paycheck, so you can convert them into income when you retire.

Stocks

Stocks are a core asset in a retirement portfolio because they offer good potential for long-term appreciation. Some additionally deliver income in the form of dividends.

Stocks come in many varieties, and each has its own risk profile. A few of the main stock categories to understand are growth stocks, value stocks, and dividend stocks.

Bonds

Bonds are debt instruments that pay interest income. They can be issued by governments, municipalities, and corporations.

U.S. government bonds, called Treasurys, are the safest, followed by municipal bonds and corporate bonds.

Bonds are also categorized by maturity. Short-term bonds are appealing because they reprice quickly to match market rates. Longer-term bonds provide stable interest payments over time.

Mutual Funds And Exchange-Traded Funds (ETFs)

Mutual Funds are pooled investment vehicles that hold multiple assets in a portfolio. When you buy one share of a mutual fund, you get exposure to every security the fund holds. This is a budget-friendly way to diversify.

Mutual funds and ETFs differ in trade timing and settlement. Mutual funds settle all trades once daily. ETFs trade throughout the day on an exchange, just like a stock.

Portfolio Management Strategies

Researching and managing the stocks, bonds, funds, and other assets in your retirement portfolio can be overwhelming. Fortunately, there are investing styles that work for everyone, whether you prefer to be hands-on or hands-off with your investments.

Active Vs. Passive Investing

An active investor buys and sells securities often. This is a research-intensive approach that looks for short-term profits by way of well-timed trades. An example is buying 100 shares of Tesla (TSLA) with the intention of selling them the moment they rise 20%.

Passive investors buy securities they can hold indefinitely. This investing style works best with large, established stocks and well-diversified funds. The goal is to build wealth via long-term compounding.

Also Read: U.S. Venture Capital Investments in Chinese Tech Under Scrutiny

Discretionary Vs. Non-Discretionary Investing

If you’d rather work alongside a broker, you can opt for a discretionary or non-discretionary arrangement.

In a discretionary account, your broker manages the securities and trades at will without your approval. In a non-discretionary account, your broker researches and makes recommendations, but needs your approval for each trade.

Reassessing Risk and Asset Allocation

As you head into retirement, you need to take a fresh look at your level of investment risk, especially the possibility of losing money from your investments. Your timeframe is one of the biggest factors in assessing risk.

Because you may no longer have time to recover from market downturns, it’s a good idea to reassess whether the proportion of your assets in higher-risk securities is greater than it should be.

You also don’t want to fall victim to inflation risk—the possibility that the change in prices will outgrow your purchasing power. Achieving the right balance isn’t easy.

If you’re concerned about making your money last your entire lifetime, consider the following questions:

What effect will taking money out of your various retirement accounts have on their ability to grow and provide income for life?

You will want to consider all of your assets and income sources, the effect of taxes, and your unique circumstances when deciding what to do with any particular account.

What sources of income can you count on for the duration of your retirement? And what are less predictable? A growing number of Americans can no longer have pensions, leaving Social Security as the only “annuity” income they can count on for life.

How diversified are your sources of income? If your investments would perform similarly during market swings, you need to diversify to protect your retirement income.

Asset Allocation

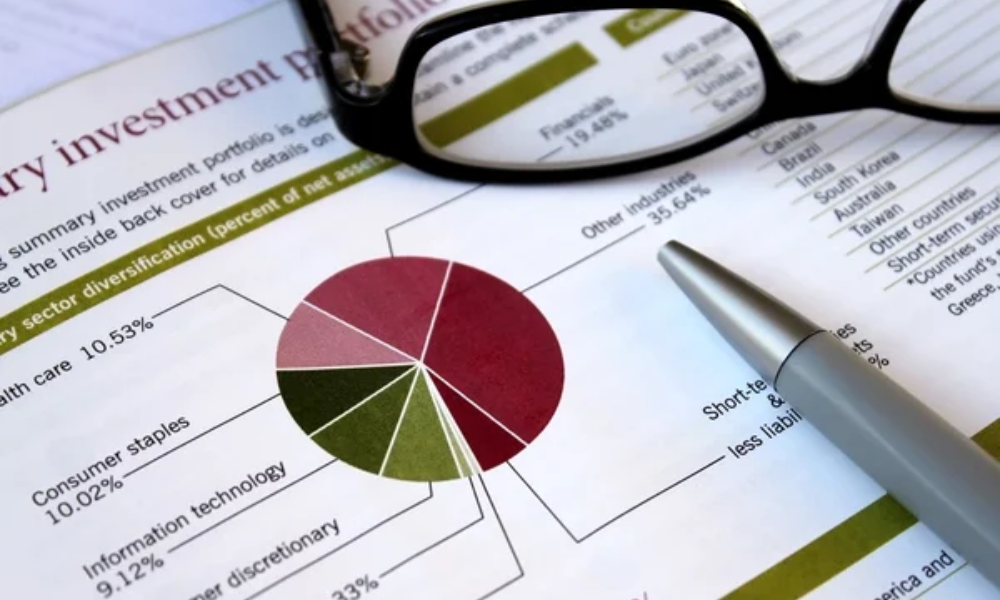

One strategic approach to investing for retirement is to maintain a particular mix of investments in your portfolio that you believe will provide the return you seek, at a level of risk you are willing to take.

The process of creating such a portfolio and spreading out your risk is known as asset allocation.

Throughout retirement, you may wish to adjust your asset allocation gradually. For instance, you might want to move money into different investments in response to a lifestyle change or to accommodate a change in economic conditions.

You can find asset allocation help from an experienced investment professional, such as your broker, a registered investment adviser, or a financial planner.

Income from Selling Your Investments

Receiving investment income isn’t the only way to draw retirement income from your investments. You can also get money by selling your investments if they are worth more than you paid for them.

Making Your Principal Last

Making your money last as long as you need it requires a disciplined approach to spending. Experts advise that you don’t overspend your first few years of retirement. They also suggest that you be prepared to cut back on extras if your retirement portfolio suffers losses in a given year.

The other key to stretching your retirement income is sound management of the yearly withdrawals you make from your retirement portfolio principal.

Failing to Plan is Planning to Fail

Building an investment portfolio for retirement requires careful planning, consistent contributions, and periodic reassessment.

By understanding the various types of investments available, implementing effective portfolio management strategies, and managing risks, individuals can work towards achieving their retirement goals and ensuring financial security in their golden years. It’s never too early—or too late—to start investing for retirement.

Read Next: This Small Cap Company Has Promising Prospects

DISCLAIMER

You should read and understand this disclaimer in its entirety before joining or viewing the website or email/blog list of SmallCapStocks.com (the “Publisher”). The information (collectively the “Advertisement”) disseminated by email, text or other method by the Publisher including this publication is a paid commercial advertisement and should not be relied upon for making an investment decision or any other purpose. The Publisher is engaged in the business of marketing and advertising the securities of publicly traded companies in exchange for compensation. The track record, gains, upside, and/or losses mentioned in the Advertisement, if any, should not be considered as true or accurate or be the basis for an investment. The Publisher does not verify the accuracy or completeness of any information included in the Advertisement. While the Publisher does not charge for the SMS service, standard carrier message and data rates may apply. To unsubscribe from receiving promotional text messages to your phone sent via an autodialer, using your phone reply to the sender’s phone number with the word STOP or HELP for help.

The Advertisement is not a solicitation or recommendation to buy securities of the advertised company. An offer to buy or sell securities can be made only by a disclosure document that complies with applicable securities laws and only in the states or other jurisdictions in which the security is eligible for sale. The Advertisement is not a disclosure document. The Advertisement is only a favorable snapshot of unverified information about the advertised company. An investor considering purchasing the securities, should always do so only with the assistance of his legal, tax and investment advisors. Investors should review with his or her investment advisor, tax advisor or attorney, if and to the extent available, any information concerning a potential investment at the web sites of the U.S. Securities and Exchange Commission (the "SEC") at www.sec.gov; the Financial Industry Regulatory Authority (the "FINRA") at www.FINRA.org, and relevant State Securities Administrator website and the OTC Markets website at www.otcmarkets.com. The Publisher cautions investors to read the SEC advisory to investors concerning Internet Stock Fraud at www.sec.gov/consumer/cyberfr.htm, as well as related information published by the FINRA on how to invest carefully. Investors are responsible for verifying all information in the Advertisement. As an advertiser, we do not verify any information we publish. The Advertisement should not be considered true or complete.

The Publisher does not offer investment advice or analysis, and the Publisher further urges you to consult your own independent tax, business, financial and investment advisors concerning any investment you make in securities particularly those quoted on the OTC Markets. Investing in securities is highly speculative and carries an extremely high degree of risk. You could lose your entire investment if you invest in any company mentioned in the Advertisement. You acknowledge that we are not an investment advisory service, a broker-dealer or an investment adviser and we are not qualified to act as such. You acknowledge that you will consult with your own independent, tax, financial and/or legal advisers regarding any decisions as to any company mentioned here. We have not determined if the Advertisement is accurate, correct or truthful. The Advertisement is compiled from publicly available information, which include, but are not limited to, no cost online research, magazines, newspapers, reports filed with the SEC or information furnished by way of press releases. Because all information relied upon by us in preparing an advertisement about an issuer comes from a public source, it is not reliable, and you should not assume it is accurate or complete.

By your subscription to our profiles, the viewing of this profile and/or use of our website, you have agreed and acknowledged the terms of our full disclaimer and privacy policy which can be viewed at the following link: www.SmallCapStocks.com/Disclaimer and www.SmallCapStocks.com/Privacy-Policy

By accepting the Advertisement, you agree and acknowledge that any hyperlinks to the website of (1) a client company, (2) the party issuing or preparing the information for the company, or (3) other information contained in the Advertisement is provided only for your reference and convenience. The advertiser is not responsible for the accuracy or reliability of these external sites, nor is it responsible for the content, opinions, products or other materials on external sites or information sources. If you use, act upon or make decisions in reliance on information contained in any disseminated report/release or any hyperlink, you do so at your own risk and agree to hold us, our officers, directors, shareholders, affiliates and agents harmless. You acknowledge that you are not relying on the Publisher, and we are not liable for, any actions taken by you based on any information contained in any disseminated email or hyperlink.

Kevin is an experienced business development strategist and content writer specializing in finance and stock market topics. He has a proven track record of driving sales and enhancing communications for small businesses by blending academic knowledge with practical experience to create engaging and accurate content.