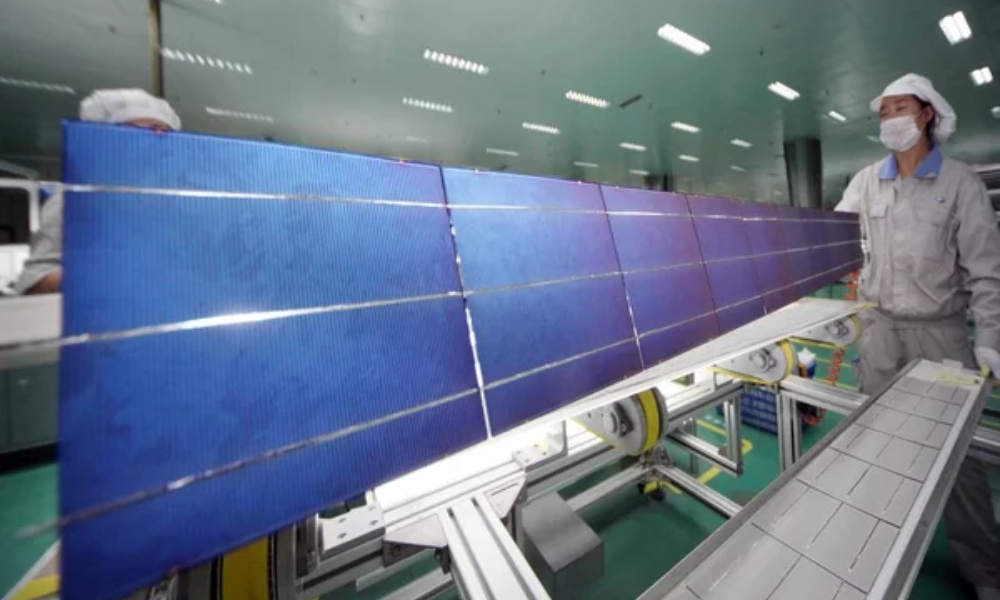

Daqo New Energy (NYSE: DQ), through its stake in one of the world’s premier polysilicon manufacturers, Xinjiang Daqo, presents a compelling narrative in the renewables sector, especially within the polysilicon market.

Listed on the Shanghai Stock Exchange, Xinjiang Daqo represents a significant portion of Daqo New Energy’s investment value, given its 72.68% ownership.

Investment Thesis Overview

Despite owning a majority stake in Xinjiang Daqo, which boasts a market capitalization of approximately 8.05 billion, Daqo New Energy’s market cap hovers around $1.74 billion.

This stark valuation gap suggests that Daqo is trading at a mere 29.9% of its net asset value (NAV), implying a potential 235% upside or $62.70 per share.

This scenario posits that investors have the opportunity to acquire Daqo shares significantly below dollar value, embedding a considerable margin of safety.

Read More: Gain Therapeutics Welcomes New Chief Medical Officer

Strategic Catalysts Ahead

Recognizing the valuation mismatch, Daqo’s management, which also oversees Xinjiang Daqo, has embarked on strategic initiatives aimed at narrowing this gap.

The company has undertaken a significant share buyback program, repurchasing around 16% of outstanding shares in 2023, with intentions to persist in these efforts.

Two pivotal developments could further fuel these buyback strategies:

Dividend Distribution from Xinjiang Daqo: A proposed dividend payout of RMB 893 million ($123 million) by Xinjiang Daqo could channel approximately $90 million to Daqo New Energy. This, combined with existing cash reserves, provides ample firepower for continued share repurchases.

Lifting of IPO Restrictions: Post-July 2024, Daqo will be permitted to sell shares of Xinjiang Daqo to fund buybacks of its ADRs, leveraging the current price disparity for value maximization.

Also Read: Teekay Tankers Sails Across the High Seas of Global Oil Trade

Operational Leverage and Market Dynamics

Xinjiang Daqo’s operational prowess, with a production capacity set to expand to 300k megatons by end-2024, positions it advantageously within various polysilicon price scenarios.

This operational leverage could significantly enhance the subsidiary’s valuation, and by extension, Daqo New Energy’s, especially if polysilicon prices rebound to historical averages.

Navigating Regulatory and Market Risks

The polysilicon industry, and by extension, Daqo New Energy, faces regulatory headwinds, notably from the Uyghur Forced Labor Prevention Act (UFLPA).

While these regulations pose potential risks, the company’s diversified production base and the complex, opaque nature of the polysilicon supply chain somewhat mitigate these concerns.

Furthermore, the global dependency on Chinese polysilicon, given its dominant market share, underscores the limited practical impact of regulatory measures on Daqo’s operations.

Competitive Landscape and Industry Dynamics

The polysilicon market is characterized by intense competition and significant supply-demand imbalances, leading to price volatility.

Despite these challenges, Daqo New Energy’s low-cost production capabilities, robust financial position, and strategic market expansions position it favorably.

However, capturing additional market share amidst evolving industry innovations and aggressive expansion by competitors requires strategic foresight.

A Multifaceted Investment Prospect

Daqo New Energy’s valuation presents a nuanced investment proposition, underpinned by its significant undervaluation relative to its ownership in Xinjiang Daqo.

While potential regulatory and operational risks loom, the strategic initiatives undertaken by Daqo’s management, coupled with the company’s operational leverage and favorable market positioning, offer an attractive risk-reward profile.

As the renewable energy landscape evolves, particularly within the polysilicon sector, Daqo New Energy’s ability to navigate these complexities and capitalize on emerging opportunities will be pivotal in realizing its intrinsic value and supporting its robust investment thesis.

Read Next: Ping An Healthcare Embraces High-Margin Medical Services and AI

DISCLAIMER

You should read and understand this disclaimer in its entirety before joining or viewing the website or email/blog list of SmallCapStocks.com (the “Publisher”). The information (collectively the “Advertisement”) disseminated by email, text or other method by the Publisher including this publication is a paid commercial advertisement and should not be relied upon for making an investment decision or any other purpose. The Publisher is engaged in the business of marketing and advertising the securities of publicly traded companies in exchange for compensation. The track record, gains, upside, and/or losses mentioned in the Advertisement, if any, should not be considered as true or accurate or be the basis for an investment. The Publisher does not verify the accuracy or completeness of any information included in the Advertisement. While the Publisher does not charge for the SMS service, standard carrier message and data rates may apply. To unsubscribe from receiving promotional text messages to your phone sent via an autodialer, using your phone reply to the sender’s phone number with the word STOP or HELP for help.

The Advertisement is not a solicitation or recommendation to buy securities of the advertised company. An offer to buy or sell securities can be made only by a disclosure document that complies with applicable securities laws and only in the states or other jurisdictions in which the security is eligible for sale. The Advertisement is not a disclosure document. The Advertisement is only a favorable snapshot of unverified information about the advertised company. An investor considering purchasing the securities, should always do so only with the assistance of his legal, tax and investment advisors. Investors should review with his or her investment advisor, tax advisor or attorney, if and to the extent available, any information concerning a potential investment at the web sites of the U.S. Securities and Exchange Commission (the "SEC") at www.sec.gov; the Financial Industry Regulatory Authority (the "FINRA") at www.FINRA.org, and relevant State Securities Administrator website and the OTC Markets website at www.otcmarkets.com. The Publisher cautions investors to read the SEC advisory to investors concerning Internet Stock Fraud at www.sec.gov/consumer/cyberfr.htm, as well as related information published by the FINRA on how to invest carefully. Investors are responsible for verifying all information in the Advertisement. As an advertiser, we do not verify any information we publish. The Advertisement should not be considered true or complete.

The Publisher does not offer investment advice or analysis, and the Publisher further urges you to consult your own independent tax, business, financial and investment advisors concerning any investment you make in securities particularly those quoted on the OTC Markets. Investing in securities is highly speculative and carries an extremely high degree of risk. You could lose your entire investment if you invest in any company mentioned in the Advertisement. You acknowledge that we are not an investment advisory service, a broker-dealer or an investment adviser and we are not qualified to act as such. You acknowledge that you will consult with your own independent, tax, financial and/or legal advisers regarding any decisions as to any company mentioned here. We have not determined if the Advertisement is accurate, correct or truthful. The Advertisement is compiled from publicly available information, which include, but are not limited to, no cost online research, magazines, newspapers, reports filed with the SEC or information furnished by way of press releases. Because all information relied upon by us in preparing an advertisement about an issuer comes from a public source, it is not reliable, and you should not assume it is accurate or complete.

By your subscription to our profiles, the viewing of this profile and/or use of our website, you have agreed and acknowledged the terms of our full disclaimer and privacy policy which can be viewed at the following link: www.SmallCapStocks.com/Disclaimer and www.SmallCapStocks.com/Privacy-Policy

By accepting the Advertisement, you agree and acknowledge that any hyperlinks to the website of (1) a client company, (2) the party issuing or preparing the information for the company, or (3) other information contained in the Advertisement is provided only for your reference and convenience. The advertiser is not responsible for the accuracy or reliability of these external sites, nor is it responsible for the content, opinions, products or other materials on external sites or information sources. If you use, act upon or make decisions in reliance on information contained in any disseminated report/release or any hyperlink, you do so at your own risk and agree to hold us, our officers, directors, shareholders, affiliates and agents harmless. You acknowledge that you are not relying on the Publisher, and we are not liable for, any actions taken by you based on any information contained in any disseminated email or hyperlink.

Joel Gbolade is a seasoned financial writer with over seven years of experience in freelance content creation. Specializing in the financial niche and stock market, he has crafted engaging content for numerous websites. His background in technology extends to data processing and computer proficiency, enriching his comprehensive skill set in the financial realm.