Plug Power Inc. has experienced significant volatility over the past two months. In mid-May 2024, the company’s stock surged following the announcement of a $1.66 billion conditional commitment loan guarantee from the Department of Energy (DOE).

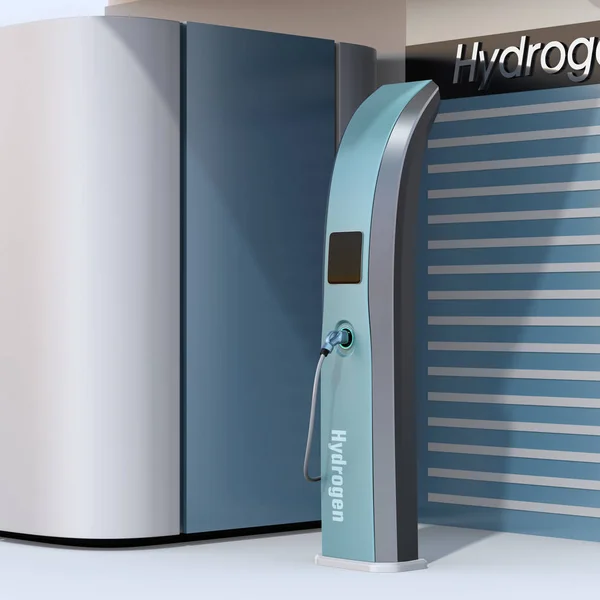

This positive news followed constructive commentary during Plug Power’s Q1 earnings call in early May. The substantial loan guarantee is expected to enhance Plug Power’s ability to expand its green hydrogen production capacity.

However, it is essential for investors to focus on Plug Power’s fundamentals and recognize the inherent uncertainties associated with the DOE’s conditional commitment.

Conditional Commitment from DOE

The DOE’s commitment to Plug Power is conditional, requiring the company to meet specific technical, legal, environmental, and financial conditions. Despite these conditions, analysts have highlighted the potential benefits for Plug Power.

Wall Street views this commitment as a significant step towards achieving the company’s long-term hydrogen ambitions. The loan guarantee aims to scale up the capacity of up to six green hydrogen production facilities across the United States.

These facilities are expected to boost demand for Plug Power’s growth opportunities in material handling, transportation, and industrial applications.

Revenue Diversification and Growth Prospects

Plug Power aims to diversify its revenue base and scale up its operations through 2025. The company anticipates increased clarity and potential in its core segments, including material handling and electrolyzers. Additionally, Plug Power plans to expand into liquefaction and other cryogenic applications.

This diversification strategy is designed to support the company’s growth and reduce dependence on any single revenue stream.

Market Pessimism and Stock Performance

Despite the initial optimism surrounding the DOE’s conditional loan guarantee, Plug Power’s stock has given up most of its gains from May and is now trading close to its 2024 lows, near the $2.25 level.

Market pessimism appears justified, given the company’s weak fundamentals and historical execution challenges. Investors are likely concerned about higher execution risks, particularly in light of the recent political developments, such as the Biden-Trump debate and the potential for increased Republican scrutiny in the Senate Energy Committee. This political uncertainty could impact market confidence in the DOE’s loan guarantee.

Short-Interest and Potential Short Squeeze

Plug Power’s short-interest ratio was nearly 28% in mid-June, indicating a significant level of bearish sentiment. Despite this, a short squeeze remains possible, particularly as the stock approaches critical support levels.

Plug Power’s continued progress in green hydrogen production aims to lower production costs and improve margins, but the company is not expected to achieve positive free cash flow profitability until at least 2026.

Financial Position and Dilution Risks

As of Q1 2024, Plug Power reported unrestricted cash of approximately $173 million. This financial position could expose investors to significant dilution risks, especially given the uncertainties surrounding the DOE’s loan guarantee and the potential return of the Trump Administration.

These factors make it challenging to be optimistic about Plug Power’s long-term prospects.

Conclusion

Plug Power Inc. remains a significant player in the green hydrogen industry, with promising opportunities for growth and diversification. However, the company’s stock has been highly volatile, and investors face considerable uncertainties, including political risks and financial challenges.

While the DOE’s conditional loan guarantee offers potential upside, it is essential to monitor Plug Power’s execution and market conditions closely.

DISCLAIMER

You should read and understand this disclaimer in its entirety before joining or viewing the website or email/blog list of SmallCapStocks.com (the “Publisher”). The information (collectively the “Advertisement”) disseminated by email, text or other method by the Publisher including this publication is a paid commercial advertisement and should not be relied upon for making an investment decision or any other purpose. The Publisher is engaged in the business of marketing and advertising the securities of publicly traded companies in exchange for compensation. The track record, gains, upside, and/or losses mentioned in the Advertisement, if any, should not be considered as true or accurate or be the basis for an investment. The Publisher does not verify the accuracy or completeness of any information included in the Advertisement. While the Publisher does not charge for the SMS service, standard carrier message and data rates may apply. To unsubscribe from receiving promotional text messages to your phone sent via an autodialer, using your phone reply to the sender’s phone number with the word STOP or HELP for help.

The Advertisement is not a solicitation or recommendation to buy securities of the advertised company. An offer to buy or sell securities can be made only by a disclosure document that complies with applicable securities laws and only in the states or other jurisdictions in which the security is eligible for sale. The Advertisement is not a disclosure document. The Advertisement is only a favorable snapshot of unverified information about the advertised company. An investor considering purchasing the securities, should always do so only with the assistance of his legal, tax and investment advisors. Investors should review with his or her investment advisor, tax advisor or attorney, if and to the extent available, any information concerning a potential investment at the web sites of the U.S. Securities and Exchange Commission (the "SEC") at www.sec.gov; the Financial Industry Regulatory Authority (the "FINRA") at www.FINRA.org, and relevant State Securities Administrator website and the OTC Markets website at www.otcmarkets.com. The Publisher cautions investors to read the SEC advisory to investors concerning Internet Stock Fraud at www.sec.gov/consumer/cyberfr.htm, as well as related information published by the FINRA on how to invest carefully. Investors are responsible for verifying all information in the Advertisement. As an advertiser, we do not verify any information we publish. The Advertisement should not be considered true or complete.

The Publisher does not offer investment advice or analysis, and the Publisher further urges you to consult your own independent tax, business, financial and investment advisors concerning any investment you make in securities particularly those quoted on the OTC Markets. Investing in securities is highly speculative and carries an extremely high degree of risk. You could lose your entire investment if you invest in any company mentioned in the Advertisement. You acknowledge that we are not an investment advisory service, a broker-dealer or an investment adviser and we are not qualified to act as such. You acknowledge that you will consult with your own independent, tax, financial and/or legal advisers regarding any decisions as to any company mentioned here. We have not determined if the Advertisement is accurate, correct or truthful. The Advertisement is compiled from publicly available information, which include, but are not limited to, no cost online research, magazines, newspapers, reports filed with the SEC or information furnished by way of press releases. Because all information relied upon by us in preparing an advertisement about an issuer comes from a public source, it is not reliable, and you should not assume it is accurate or complete.

By your subscription to our profiles, the viewing of this profile and/or use of our website, you have agreed and acknowledged the terms of our full disclaimer and privacy policy which can be viewed at the following link: www.SmallCapStocks.com/Disclaimer and www.SmallCapStocks.com/Privacy-Policy

By accepting the Advertisement, you agree and acknowledge that any hyperlinks to the website of (1) a client company, (2) the party issuing or preparing the information for the company, or (3) other information contained in the Advertisement is provided only for your reference and convenience. The advertiser is not responsible for the accuracy or reliability of these external sites, nor is it responsible for the content, opinions, products or other materials on external sites or information sources. If you use, act upon or make decisions in reliance on information contained in any disseminated report/release or any hyperlink, you do so at your own risk and agree to hold us, our officers, directors, shareholders, affiliates and agents harmless. You acknowledge that you are not relying on the Publisher, and we are not liable for, any actions taken by you based on any information contained in any disseminated email or hyperlink.