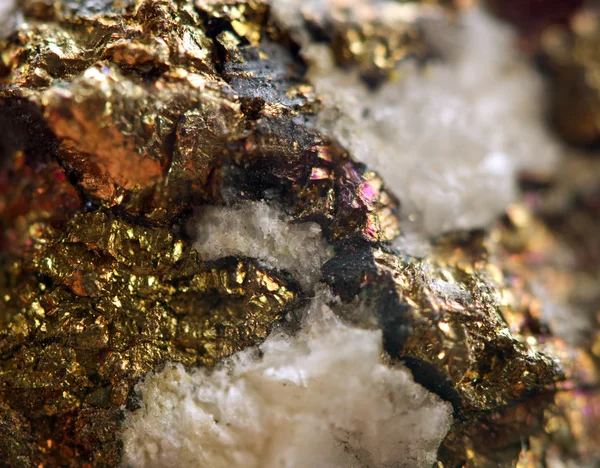

In an era where environmental sustainability and the transition to greener technologies are at the forefront of global agendas, the significance of silver, both as an industrial metal and an investment asset, has escalated.

The burgeoning push towards electric vehicles (EVs) and renewable energy sources, including solar panels, is intensifying the demand for silver.

The Environmental Push Elevating Silver Demand

The global endeavor to achieve Carbon Zero has spotlighted various strategies to mitigate environmental degradation, prominently featuring the switch to Electric Vehicles and the adoption of solar energy.

Silver’s pivotal role in these technologies, alongside its traditional uses in industries such as medicine, water purification, and jewelry, has led to a notable increase in its demand.

This uptick is poised to exert upward pressure on silver prices, further underscored by the potential for pandemic-induced shifts in consumer behavior.

The prospect of future lockdowns raises the likelihood of increased demand for electronics that rely on silver, such as flat-screen monitors and entertainment systems, making the case for silver’s growing market strength.

Investment Strategy in Light of Rising Silver Prices

Given the anticipated ascendancy of silver prices, aligning investment portfolios to include silver production companies represents a forward-thinking strategy.

Fortuna Silver Mines Inc., a prominent player in the silver mining industry, emerges as a company well-positioned to benefit from these market dynamics.

Fortuna Silver Mines Inc.: An Overview

Fortuna Silver Mines Inc. (NYSE: FSM), headquartered in Canada, boasts a diverse portfolio of gold and silver mines across Argentina, Burkina Faso, Côte d’Ivoire, Peru, and Mexico.

The geographical spread of its operations introduces a layer of geopolitical risk, necessitating a thorough risk analysis for investors considering this market segment.

Recent Financial Milestones and Market Dynamics

Fortuna has demonstrated financial diligence by repaying $40 million of its credit facility, a significant reduction of its debt.

Additionally, the company’s strategic share repurchase program, buying back shares at a lower price than their current market value, signals management’s confidence in the company’s valuation and future prospects.

Despite a dip in silver production in 2024 compared to the previous year, Fortuna’s market capitalization of $1.435 billion and its trading volume suggest a stable liquidity position, facilitating ease of investment transactions.

However, the negative earnings per share (EPS) raises certain concerns, yet when benchmarked against peers within the sector, Fortuna’s financial performance remains competitive.

Technical Indicators and Comparative Analysis

The technical analysis of Fortuna Silver Mines’ stock indicates a potential market correction, as evidenced by overbought conditions.

This scenario underscores the importance of a cautious investment approach, especially given the stock’s significant gains in a relatively short period.

Comparatively, Fortuna has shown commendable resilience and growth among its peers, signaling its robust position in the silver mining sector.

Silver Market Prospects and Investment Implications

The current price of silver, juxtaposed with its all-time highs and the Gold/Silver Ratio, suggests a potential for considerable market revaluation.

The author’s decision to maintain a long position in Fortuna, augmented by strategic put options to mitigate risks, underscores a nuanced understanding of market dynamics and the intricacies of silver market investments.

Move Towards Green Economy Increases Demand for Silver

The trajectory towards environmental sustainability and the adoption of green technologies heralds a promising horizon for silver demand.

Fortuna Silver Mines Inc. represents a strategic investment opportunity within this evolving market landscape.

While the enthusiasm for silver and its applications in green technologies is palpable, investors are encouraged to navigate the market with strategic foresight, balancing the allure of potential gains with the prudence of risk management.

As the silver market continues its dynamic evolution, a judicious investment approach, characterized by layered trades and preparedness for volatility, will be pivotal in capitalizing on the opportunities that lie ahead in this lustrous sector.

DISCLAIMER

You should read and understand this disclaimer in its entirety before joining or viewing the website or email/blog list of SmallCapStocks.com (the “Publisher”). The information (collectively the “Advertisement”) disseminated by email, text or other method by the Publisher including this publication is a paid commercial advertisement and should not be relied upon for making an investment decision or any other purpose. The Publisher is engaged in the business of marketing and advertising the securities of publicly traded companies in exchange for compensation. The track record, gains, upside, and/or losses mentioned in the Advertisement, if any, should not be considered as true or accurate or be the basis for an investment. The Publisher does not verify the accuracy or completeness of any information included in the Advertisement. While the Publisher does not charge for the SMS service, standard carrier message and data rates may apply. To unsubscribe from receiving promotional text messages to your phone sent via an autodialer, using your phone reply to the sender’s phone number with the word STOP or HELP for help.

The Advertisement is not a solicitation or recommendation to buy securities of the advertised company. An offer to buy or sell securities can be made only by a disclosure document that complies with applicable securities laws and only in the states or other jurisdictions in which the security is eligible for sale. The Advertisement is not a disclosure document. The Advertisement is only a favorable snapshot of unverified information about the advertised company. An investor considering purchasing the securities, should always do so only with the assistance of his legal, tax and investment advisors. Investors should review with his or her investment advisor, tax advisor or attorney, if and to the extent available, any information concerning a potential investment at the web sites of the U.S. Securities and Exchange Commission (the "SEC") at www.sec.gov; the Financial Industry Regulatory Authority (the "FINRA") at www.FINRA.org, and relevant State Securities Administrator website and the OTC Markets website at www.otcmarkets.com. The Publisher cautions investors to read the SEC advisory to investors concerning Internet Stock Fraud at www.sec.gov/consumer/cyberfr.htm, as well as related information published by the FINRA on how to invest carefully. Investors are responsible for verifying all information in the Advertisement. As an advertiser, we do not verify any information we publish. The Advertisement should not be considered true or complete.

The Publisher does not offer investment advice or analysis, and the Publisher further urges you to consult your own independent tax, business, financial and investment advisors concerning any investment you make in securities particularly those quoted on the OTC Markets. Investing in securities is highly speculative and carries an extremely high degree of risk. You could lose your entire investment if you invest in any company mentioned in the Advertisement. You acknowledge that we are not an investment advisory service, a broker-dealer or an investment adviser and we are not qualified to act as such. You acknowledge that you will consult with your own independent, tax, financial and/or legal advisers regarding any decisions as to any company mentioned here. We have not determined if the Advertisement is accurate, correct or truthful. The Advertisement is compiled from publicly available information, which include, but are not limited to, no cost online research, magazines, newspapers, reports filed with the SEC or information furnished by way of press releases. Because all information relied upon by us in preparing an advertisement about an issuer comes from a public source, it is not reliable, and you should not assume it is accurate or complete.

By your subscription to our profiles, the viewing of this profile and/or use of our website, you have agreed and acknowledged the terms of our full disclaimer and privacy policy which can be viewed at the following link: www.SmallCapStocks.com/Disclaimer and www.SmallCapStocks.com/Privacy-Policy

By accepting the Advertisement, you agree and acknowledge that any hyperlinks to the website of (1) a client company, (2) the party issuing or preparing the information for the company, or (3) other information contained in the Advertisement is provided only for your reference and convenience. The advertiser is not responsible for the accuracy or reliability of these external sites, nor is it responsible for the content, opinions, products or other materials on external sites or information sources. If you use, act upon or make decisions in reliance on information contained in any disseminated report/release or any hyperlink, you do so at your own risk and agree to hold us, our officers, directors, shareholders, affiliates and agents harmless. You acknowledge that you are not relying on the Publisher, and we are not liable for, any actions taken by you based on any information contained in any disseminated email or hyperlink.

Faith is an enthusiastic freelancer and regular contributor to numerous finance blogs, creating valuable pieces to educate individuals on finance and fintech options. As a skilled writer, Faith has created content for diverse industries—if it exists, she’s likely written about it!