In the stock market, SoundHound (NASDAQ: SOUN) has recently emerged as a focal point, propelled by Nvidia’s (NVDA) disclosed investment. However, beneath the surface of this headline-grabbing development lies a complex narrative.

Despite SoundHound’s trailblazing position in the Voice AI industry and a commendable Q1 earnings report, lingering uncertainties persist regarding the company’s valuation and long-term viability.

This analysis delves deep into SoundHound’s financial underpinnings, future prospects, and valuation metrics, offering a discerning perspective for potential investors.

Fundamental Analysis

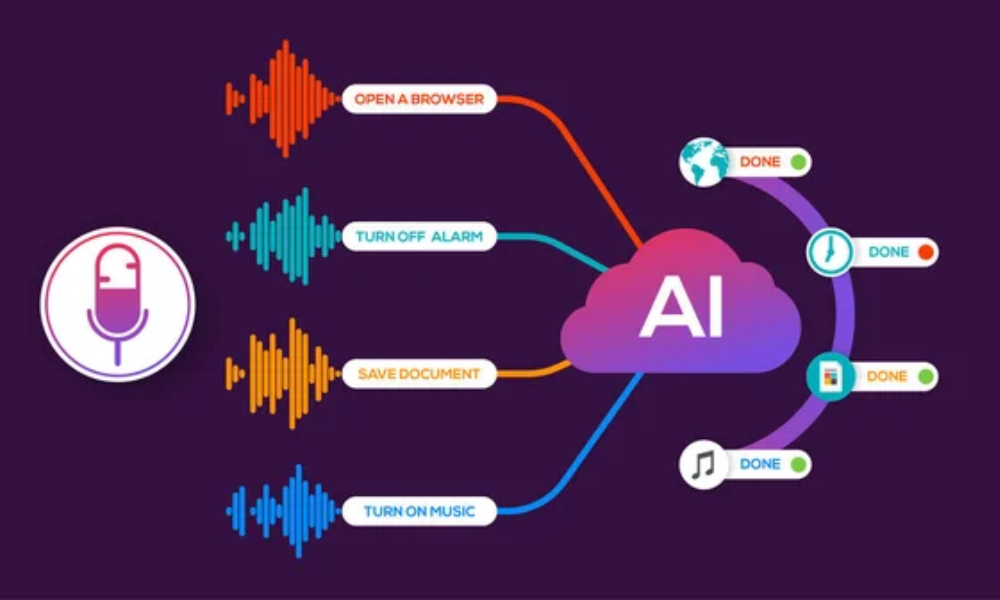

SoundHound’s core identity, as delineated in its FY 2023 10-K report, positions it as a global leader in conversational intelligence, providing independent Voice AI solutions across a spectrum of industries.

With market projections exceeding $160 billion by 2026, SoundHound stands poised to harness the escalating demand for Voice AI applications across diverse sectors, including IoT, automotive, retail, and beyond.

Q1 Earnings Analysis

SoundHound’s Q1 earnings report unveiled a stellar 73% YoY revenue growth, showcasing the efficacy of the company’s aggressive expansion strategies. However, despite the revenue surge, operational challenges persist as evidenced by widening operating losses.

Although cash flow from operations remains negative, SoundHound’s robust liquidity position, boasting $211 million in cash, provides a cushion against immediate financial pressures.

Financial Metrics

Despite ample liquidity, SoundHound resorts to issuing new shares to bolster its financial reserves, triggering concerns of shareholder dilution.

Revenue streams predominantly stem from product royalties and subscription services, with SYNQ3 revenue playing a pivotal role in driving growth.

However, the issuance of additional shares underscores the delicate balance between capital infusion and shareholder value preservation.

Future Outlook

Management’s bullish outlook underscores SoundHound’s ambitious growth trajectory, as evidenced by an upgraded FY 2024 revenue guidance of $71 million and aspirations to surpass $100 million in revenue by FY 2025, alongside a pursuit of adjusted EBITDA profitability.

Bolstered by a robust customer portfolio and a commitment to innovation, SoundHound aims to leverage its expanding patent base to fuel future expansion.

Valuation Analysis

Traditional valuation metrics falter in assessing SoundHound’s unprofitable status and the absence of direct competitors.

A discounted cash flow (DCF) analysis, incorporating optimistic assumptions, yields a fair share price of $1.21, significantly below the prevailing market price. This glaring divergence underscores the specter of overvaluation, warranting circumspection among prospective investors.

Current Valuation Presents Potential Conundrum

While SoundHound exudes promise and potential, its current valuation presents a conundrum for prudent investors.

Despite short-term volatility and tantalizing prospects of acquisition interest, the prevailing overvaluation casts a pall over SoundHound’s investment thesis.

While the company’s revenue growth trajectory commands admiration, it fails to reconcile with its lofty market capitalization, prompting caution among discerning investors.

Focus on Fundamentals

Armed with a nuanced understanding of the company’s fundamentals and valuation dynamics, investors can navigate the intricacies of the market with prudence, ensuring that their investment decisions align with their long-term objectives.

With a judicious approach and a steadfast focus on fundamentals, investors can navigate the complexities of SoundHound’s investment proposition, steering clear of potential pitfalls while capitalizing on its transformative potential in the Voice AI sphere.

DISCLAIMER

You should read and understand this disclaimer in its entirety before joining or viewing the website or email/blog list of SmallCapStocks.com (the “Publisher”). The information (collectively the “Advertisement”) disseminated by email, text or other method by the Publisher including this publication is a paid commercial advertisement and should not be relied upon for making an investment decision or any other purpose. The Publisher is engaged in the business of marketing and advertising the securities of publicly traded companies in exchange for compensation. The track record, gains, upside, and/or losses mentioned in the Advertisement, if any, should not be considered as true or accurate or be the basis for an investment. The Publisher does not verify the accuracy or completeness of any information included in the Advertisement. While the Publisher does not charge for the SMS service, standard carrier message and data rates may apply. To unsubscribe from receiving promotional text messages to your phone sent via an autodialer, using your phone reply to the sender’s phone number with the word STOP or HELP for help.

The Advertisement is not a solicitation or recommendation to buy securities of the advertised company. An offer to buy or sell securities can be made only by a disclosure document that complies with applicable securities laws and only in the states or other jurisdictions in which the security is eligible for sale. The Advertisement is not a disclosure document. The Advertisement is only a favorable snapshot of unverified information about the advertised company. An investor considering purchasing the securities, should always do so only with the assistance of his legal, tax and investment advisors. Investors should review with his or her investment advisor, tax advisor or attorney, if and to the extent available, any information concerning a potential investment at the web sites of the U.S. Securities and Exchange Commission (the "SEC") at www.sec.gov; the Financial Industry Regulatory Authority (the "FINRA") at www.FINRA.org, and relevant State Securities Administrator website and the OTC Markets website at www.otcmarkets.com. The Publisher cautions investors to read the SEC advisory to investors concerning Internet Stock Fraud at www.sec.gov/consumer/cyberfr.htm, as well as related information published by the FINRA on how to invest carefully. Investors are responsible for verifying all information in the Advertisement. As an advertiser, we do not verify any information we publish. The Advertisement should not be considered true or complete.

The Publisher does not offer investment advice or analysis, and the Publisher further urges you to consult your own independent tax, business, financial and investment advisors concerning any investment you make in securities particularly those quoted on the OTC Markets. Investing in securities is highly speculative and carries an extremely high degree of risk. You could lose your entire investment if you invest in any company mentioned in the Advertisement. You acknowledge that we are not an investment advisory service, a broker-dealer or an investment adviser and we are not qualified to act as such. You acknowledge that you will consult with your own independent, tax, financial and/or legal advisers regarding any decisions as to any company mentioned here. We have not determined if the Advertisement is accurate, correct or truthful. The Advertisement is compiled from publicly available information, which include, but are not limited to, no cost online research, magazines, newspapers, reports filed with the SEC or information furnished by way of press releases. Because all information relied upon by us in preparing an advertisement about an issuer comes from a public source, it is not reliable, and you should not assume it is accurate or complete.

By your subscription to our profiles, the viewing of this profile and/or use of our website, you have agreed and acknowledged the terms of our full disclaimer and privacy policy which can be viewed at the following link: www.SmallCapStocks.com/Disclaimer and www.SmallCapStocks.com/Privacy-Policy

By accepting the Advertisement, you agree and acknowledge that any hyperlinks to the website of (1) a client company, (2) the party issuing or preparing the information for the company, or (3) other information contained in the Advertisement is provided only for your reference and convenience. The advertiser is not responsible for the accuracy or reliability of these external sites, nor is it responsible for the content, opinions, products or other materials on external sites or information sources. If you use, act upon or make decisions in reliance on information contained in any disseminated report/release or any hyperlink, you do so at your own risk and agree to hold us, our officers, directors, shareholders, affiliates and agents harmless. You acknowledge that you are not relying on the Publisher, and we are not liable for, any actions taken by you based on any information contained in any disseminated email or hyperlink.

I’m Elizabeth Monroe, a writer who brings you stories from around the world. I’m passionate about sharing important global news and amplifying the voices of those often left unheard. Through my writing, I aim to make the world feel a bit closer and more accessible.