Aehr Test Systems may be experiencing a downturn in its business cycle, but its long-term growth potential remains intact. With no long-term debt and management’s expectations for a reversal of the recent slowdown, the small-cap player in the semiconductor manufacturing industry is poised to weather the storm.

The significant increase in backlog and bookings should set AEHR back on the right track.

Company Overview

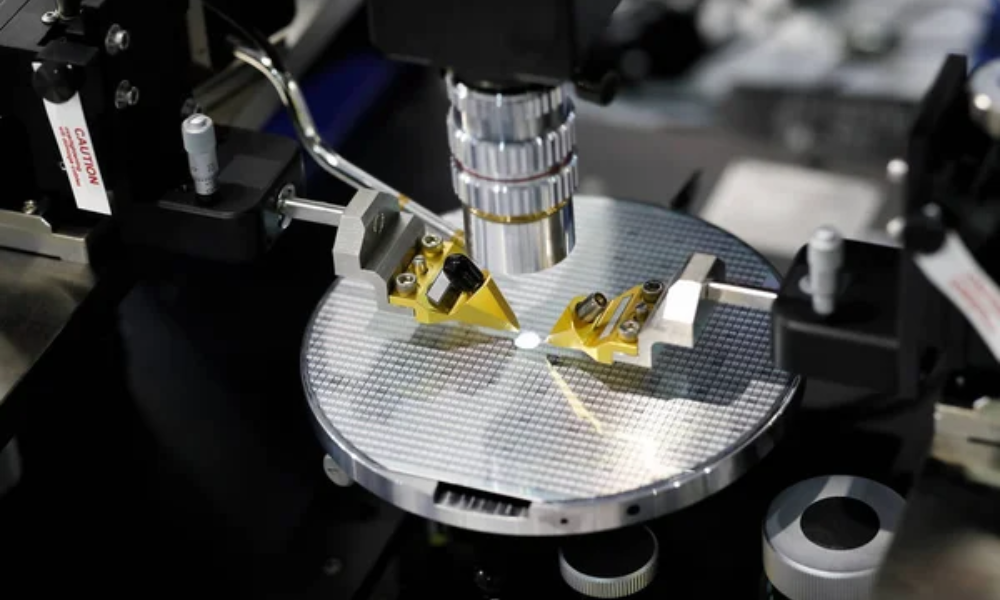

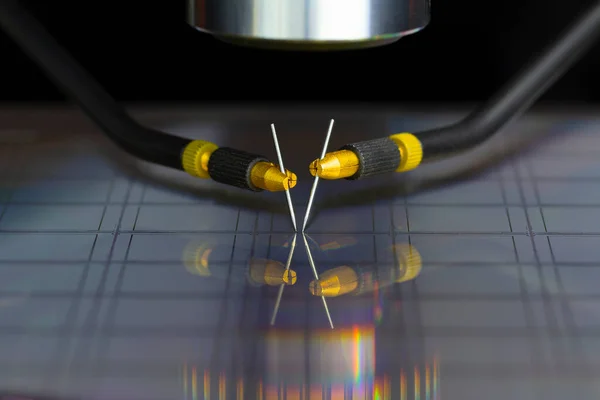

Aehr Test Systems provides semiconductor wafer testing and burn-in solutions, primarily for Silicon Carbide (SiC) chips used in full battery electric vehicle (EV) applications. The recent slowdown in the EV market has disproportionately impacted AEHR’s financials.

Delayed deliveries, increased inventory, and lowered guidance have hit the stock hard, but this also presents a potential opportunity for long-term investors.

Financial Performance

In the quarter ending February 29, 2024, AEHR reported a sharp decline in revenue, gross profit, and operating income. This led the company to pre-announce results and lower guidance prior to the earnings report. As a result, AEHR shifted from profitability to operating and net losses in Q3.

Despite the recent downturn, AEHR’s financials have shown resilience in the past. During the pandemic, cash flows increased significantly, demonstrating the company’s ability to navigate challenging market conditions.

However, inventory has increased sequentially, and the cash conversion cycle has skyrocketed. The company needs to turn its inventory into cash more quickly to improve its financials.

A Second Half Story?

AEHR is expected to finish its fiscal year strong. During the Q3 earnings call, management reiterated its full-year guidance of greater than $65 million in revenue and at least $11 million in net income. This suggests that the company will recognize at least $15.4 million in revenue and $2.7 million in net income in Q4.

Revenue was impacted by delayed orders and over-inventory across its customers. Sequentially, quarterly bookings improved from $2.2 million in Q2 to $24.5 million in Q3.

Meanwhile, backlog increased from $3 million to $20 million, and the company received an order from a new customer. This indicates that AEHR may have bottomed out, and it will be interesting to see how much revenue is recognized in Q4.

Valuation

As the stock price has fallen, AEHR’s valuation has become more reasonable. Using TTM figures, the company currently trades at a P/S of 5.1x, a P/GP of 10.4x, and a P/E of 25.8x. Compared to its average valuations since May 2021, the current P/S ratio is roughly 51.5% lower, the P/Gross Profit is lower by 54%, and the P/E is 59% lower.

While the stock still trades at a premium to the market, its growth potential justifies some amount of premium.

A reverse DCF analysis with a 15.0% discount rate and a 4.0% terminal rate suggests that AEHR needs to grow its FCF at a CAGR of 37.4% off its trailing twelve-month base of $4.5 million to deliver a roughly 15% annualized return for shareholders. If stock-based compensation is subtracted, the required growth rate increases to a 43.2% CAGR.

Growth Outlook

Analysts expect top-line and profit growth to return by fiscal 2025, with explosive growth anticipated by 2026. The silicon carbide semiconductor market is expected to grow at a high rate, with estimates ranging from 23.8% to 32.6% CAGR. AEHR’s testing and burn-in products help companies save money and increase profits by ensuring reliability and performance. As the market grows, demand for AEHR’s services should grow along with it.

The EV Market

The EV market is still growing, despite recent softening. Goldman Sachs estimates a 10.9% CAGR for EV sales between 2023 and 2040 in a bearish scenario, with a 20.2% CAGR between 2023 and 2029 in a base case scenario. AEHR’s business is not entirely reliant on fully electric vehicle applications, as hybrid and plug-in hybrids also benefit from the use of SiC chips.

Other Areas of Growth

AEHR has opportunities to grow in Asia and in new product areas such as Gallium nitride testing systems, NAND and DRAM applications in the memory market, and Silicon Photonics. These areas are relatively new for the company and may take many quarters to become significant parts of the business.

Risks

AEHR faces risks from inventory backup, customer concentration, and reliance on the EV market. The company’s financials have deteriorated, and a further slowdown in the EV market could impact its revenues. However, the long-term growth potential and improving market conditions suggest that AEHR is well-positioned to recover.

Long-Term Potential Remains

Investing in AEHR requires patience and a long-term perspective. Investors with strong conviction in the growth story can consider dollar-cost averaging into the stock while it is near its bottom. Waiting for signs of improvement in inventory and revenue growth before investing could also be a prudent strategy.

If the growth story unfolds as expected, AEHR has the potential to deliver significant returns, making it a compelling investment opportunity.

DISCLAIMER

You should read and understand this disclaimer in its entirety before joining or viewing the website or email/blog list of SmallCapStocks.com (the “Publisher”). The information (collectively the “Advertisement”) disseminated by email, text or other method by the Publisher including this publication is a paid commercial advertisement and should not be relied upon for making an investment decision or any other purpose. The Publisher is engaged in the business of marketing and advertising the securities of publicly traded companies in exchange for compensation. The track record, gains, upside, and/or losses mentioned in the Advertisement, if any, should not be considered as true or accurate or be the basis for an investment. The Publisher does not verify the accuracy or completeness of any information included in the Advertisement. While the Publisher does not charge for the SMS service, standard carrier message and data rates may apply. To unsubscribe from receiving promotional text messages to your phone sent via an autodialer, using your phone reply to the sender’s phone number with the word STOP or HELP for help.

The Advertisement is not a solicitation or recommendation to buy securities of the advertised company. An offer to buy or sell securities can be made only by a disclosure document that complies with applicable securities laws and only in the states or other jurisdictions in which the security is eligible for sale. The Advertisement is not a disclosure document. The Advertisement is only a favorable snapshot of unverified information about the advertised company. An investor considering purchasing the securities, should always do so only with the assistance of his legal, tax and investment advisors. Investors should review with his or her investment advisor, tax advisor or attorney, if and to the extent available, any information concerning a potential investment at the web sites of the U.S. Securities and Exchange Commission (the "SEC") at www.sec.gov; the Financial Industry Regulatory Authority (the "FINRA") at www.FINRA.org, and relevant State Securities Administrator website and the OTC Markets website at www.otcmarkets.com. The Publisher cautions investors to read the SEC advisory to investors concerning Internet Stock Fraud at www.sec.gov/consumer/cyberfr.htm, as well as related information published by the FINRA on how to invest carefully. Investors are responsible for verifying all information in the Advertisement. As an advertiser, we do not verify any information we publish. The Advertisement should not be considered true or complete.

The Publisher does not offer investment advice or analysis, and the Publisher further urges you to consult your own independent tax, business, financial and investment advisors concerning any investment you make in securities particularly those quoted on the OTC Markets. Investing in securities is highly speculative and carries an extremely high degree of risk. You could lose your entire investment if you invest in any company mentioned in the Advertisement. You acknowledge that we are not an investment advisory service, a broker-dealer or an investment adviser and we are not qualified to act as such. You acknowledge that you will consult with your own independent, tax, financial and/or legal advisers regarding any decisions as to any company mentioned here. We have not determined if the Advertisement is accurate, correct or truthful. The Advertisement is compiled from publicly available information, which include, but are not limited to, no cost online research, magazines, newspapers, reports filed with the SEC or information furnished by way of press releases. Because all information relied upon by us in preparing an advertisement about an issuer comes from a public source, it is not reliable, and you should not assume it is accurate or complete.

By your subscription to our profiles, the viewing of this profile and/or use of our website, you have agreed and acknowledged the terms of our full disclaimer and privacy policy which can be viewed at the following link: www.SmallCapStocks.com/Disclaimer and www.SmallCapStocks.com/Privacy-Policy

By accepting the Advertisement, you agree and acknowledge that any hyperlinks to the website of (1) a client company, (2) the party issuing or preparing the information for the company, or (3) other information contained in the Advertisement is provided only for your reference and convenience. The advertiser is not responsible for the accuracy or reliability of these external sites, nor is it responsible for the content, opinions, products or other materials on external sites or information sources. If you use, act upon or make decisions in reliance on information contained in any disseminated report/release or any hyperlink, you do so at your own risk and agree to hold us, our officers, directors, shareholders, affiliates and agents harmless. You acknowledge that you are not relying on the Publisher, and we are not liable for, any actions taken by you based on any information contained in any disseminated email or hyperlink.