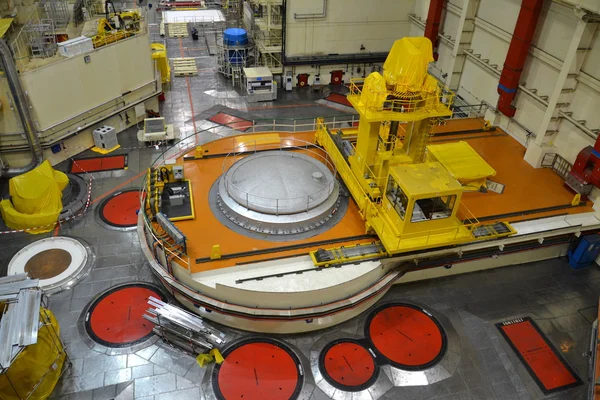

NuScale Power, a trailblazer in the nuclear energy sector, has been at the forefront of designing and developing small modular reactors (SMRs) since its inception in 2007.

Its journey from a private entity to a publicly traded company on the NYSE under the ticker SMR has been marked by significant milestones and challenges.

Market Performance and Financial Health

NuScale Power made its public debut in 2022 with an initial share price of $10. Despite experiencing a somewhat tepid market reception initially, with the share price dipping to around $3 earlier this year, a recent uptick was observed following the Q4 earnings call.

The share price momentarily revisited its debut level of $10 in March before adjusting to $5.7, reflecting a year-to-date increase of 82%, albeit a 43% decrease since its IPO.

Read More: Natural Gas Sector Focuses on Appalachia for 2024 and Beyond

Financial Milestones and Challenges

The fiscal year 2023 presented a mixed bag for NuScale Power. The company reported a steady revenue growth, nearing $23 million. However, it continued to grapple with substantial operational cash outflows, amounting to $183 million in the same period.

The stark contrast between its R&D expenditure — nearly seven times its revenue — and the generated income underscores the substantial financial hurdles NuScale faces, particularly in translating its technological advancements into profitable ventures.

Strategic Analysis and Future Outlook

The rising global demand for data centers, propelled by the advent of AI and the exponential growth of digital data, presents a unique opportunity for NuScale Power.

The company’s small footprint and low carbon emissions make its SMR technology an ideal candidate for powering these energy-intensive facilities.

With the International Energy Agency projecting data centers to account for 6% of total energy consumption by 2026, NuScale is poised to tap into a burgeoning market potentially worth over $200 billion.

Also Read: iBio Unveils Revolutionizing ShieldTx Antibody Delivery with AI

Legislative Tailwinds and Policy Catalysts

A promising development for NuScale is the proposed legislation aimed at supporting the SMR industry.

An $800 million grant for the development and deployment of SMR technology, alongside an additional $100 million for manufacturing, is currently under consideration.

This policy move, signaling strong government backing, could serve as a significant catalyst for NuScale, offering both financial support and market confidence.

The Road Ahead

Despite the optimism, NuScale’s path is fraught with challenges, notably the termination of its pioneering SMR project in Utah due to financial constraints and questions about the commercial viability of SMR technology at scale.

Moreover, the company’s liquidity position, starting FY 2024 with just $120 million, underscores the pressing need to manage operational expenses and seek additional capital to sustain its ambitious projects.

Assessing NuScale Power’s Position

As NuScale Power navigates the complexities of the nuclear energy market, its potential for high returns comes with inherent risks.

The company’s strategic focus on data centers, combined with anticipated legislative support, positions it to leverage the ongoing energy transition effectively.

However, achieving financial sustainability and operational efficiency remains paramount for capitalizing on these opportunities.

Read Next: Rumble’s High Hopes Meet Harsh Realities

DISCLAIMER

You should read and understand this disclaimer in its entirety before joining or viewing the website or email/blog list of SmallCapStocks.com (the “Publisher”). The information (collectively the “Advertisement”) disseminated by email, text or other method by the Publisher including this publication is a paid commercial advertisement and should not be relied upon for making an investment decision or any other purpose. The Publisher is engaged in the business of marketing and advertising the securities of publicly traded companies in exchange for compensation. The track record, gains, upside, and/or losses mentioned in the Advertisement, if any, should not be considered as true or accurate or be the basis for an investment. The Publisher does not verify the accuracy or completeness of any information included in the Advertisement. While the Publisher does not charge for the SMS service, standard carrier message and data rates may apply. To unsubscribe from receiving promotional text messages to your phone sent via an autodialer, using your phone reply to the sender’s phone number with the word STOP or HELP for help.

The Advertisement is not a solicitation or recommendation to buy securities of the advertised company. An offer to buy or sell securities can be made only by a disclosure document that complies with applicable securities laws and only in the states or other jurisdictions in which the security is eligible for sale. The Advertisement is not a disclosure document. The Advertisement is only a favorable snapshot of unverified information about the advertised company. An investor considering purchasing the securities, should always do so only with the assistance of his legal, tax and investment advisors. Investors should review with his or her investment advisor, tax advisor or attorney, if and to the extent available, any information concerning a potential investment at the web sites of the U.S. Securities and Exchange Commission (the "SEC") at www.sec.gov; the Financial Industry Regulatory Authority (the "FINRA") at www.FINRA.org, and relevant State Securities Administrator website and the OTC Markets website at www.otcmarkets.com. The Publisher cautions investors to read the SEC advisory to investors concerning Internet Stock Fraud at www.sec.gov/consumer/cyberfr.htm, as well as related information published by the FINRA on how to invest carefully. Investors are responsible for verifying all information in the Advertisement. As an advertiser, we do not verify any information we publish. The Advertisement should not be considered true or complete.

The Publisher does not offer investment advice or analysis, and the Publisher further urges you to consult your own independent tax, business, financial and investment advisors concerning any investment you make in securities particularly those quoted on the OTC Markets. Investing in securities is highly speculative and carries an extremely high degree of risk. You could lose your entire investment if you invest in any company mentioned in the Advertisement. You acknowledge that we are not an investment advisory service, a broker-dealer or an investment adviser and we are not qualified to act as such. You acknowledge that you will consult with your own independent, tax, financial and/or legal advisers regarding any decisions as to any company mentioned here. We have not determined if the Advertisement is accurate, correct or truthful. The Advertisement is compiled from publicly available information, which include, but are not limited to, no cost online research, magazines, newspapers, reports filed with the SEC or information furnished by way of press releases. Because all information relied upon by us in preparing an advertisement about an issuer comes from a public source, it is not reliable, and you should not assume it is accurate or complete.

By your subscription to our profiles, the viewing of this profile and/or use of our website, you have agreed and acknowledged the terms of our full disclaimer and privacy policy which can be viewed at the following link: www.SmallCapStocks.com/Disclaimer and www.SmallCapStocks.com/Privacy-Policy

By accepting the Advertisement, you agree and acknowledge that any hyperlinks to the website of (1) a client company, (2) the party issuing or preparing the information for the company, or (3) other information contained in the Advertisement is provided only for your reference and convenience. The advertiser is not responsible for the accuracy or reliability of these external sites, nor is it responsible for the content, opinions, products or other materials on external sites or information sources. If you use, act upon or make decisions in reliance on information contained in any disseminated report/release or any hyperlink, you do so at your own risk and agree to hold us, our officers, directors, shareholders, affiliates and agents harmless. You acknowledge that you are not relying on the Publisher, and we are not liable for, any actions taken by you based on any information contained in any disseminated email or hyperlink.

Dean is a freelance content writer who contributes to various Digital Media Companies and independent websites all over the world. He has over 20 years of financial industry experience, so it’s safe to say he’s well informed.