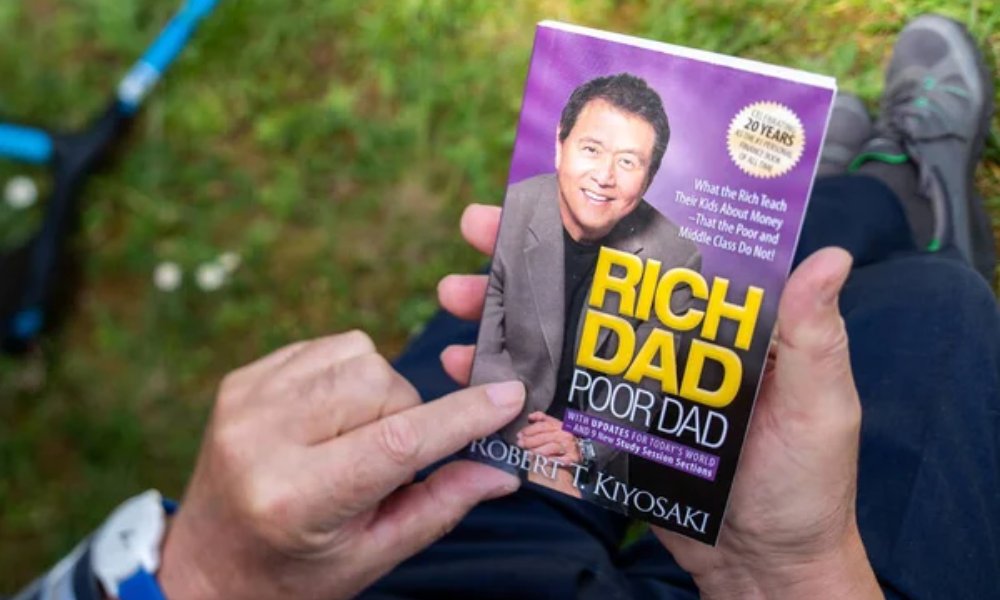

Robert Kiyosaki, the author of the best-selling book “Rich Dad Poor Dad,” has become a household name in the realm of personal finance. His unique insights and straightforward advice have helped millions of people around the world understand the importance of financial education.

Here are ten financial nuggets from Robert Kiyosaki that can guide you toward financial success.

-

Understand the Difference Between Assets and Liabilities

Credits: DepositPhotos

One of Kiyosaki’s key teachings is the importance of distinguishing between assets and liabilities. He explains that assets put money in your pocket, while liabilities take money out. By focusing on acquiring assets, such as real estate, stocks, and businesses, you can build wealth over time.

-

Embrace Financial Education

Kiyosaki emphasizes the importance of financial education. He believes that understanding how money works is crucial for making informed decisions. This includes learning about investing, taxes, and financial markets. Continually educating yourself can lead to better financial choices and opportunities.

-

The Power of Passive Income

Passive income is a recurring theme in Kiyosaki’s teachings. He advocates for creating streams of income that do not require your active involvement. This can include rental income, dividends, or royalties. By building passive income, you can achieve financial freedom and reduce reliance on a traditional paycheck.

-

Think Like an Entrepreneur

Kiyosaki encourages thinking like an entrepreneur rather than an employee. This mindset shift involves looking for opportunities to create value and solve problems. By developing entrepreneurial skills, you can identify new income streams and become more adaptable in changing economic conditions.

-

Invest in Real Estate

Real estate investing is a cornerstone of Kiyosaki’s financial advice. He believes that real estate can provide steady cash flow, tax advantages, and long-term appreciation. Whether it’s residential, commercial, or rental properties, investing in real estate can be a powerful way to build wealth.

-

Use Debt Wisely

Contrary to popular belief, Kiyosaki doesn’t consider all debt to be bad. He differentiates between good debt and bad debt. Good debt is used to acquire assets that generate income, while bad debt is used for liabilities that do not provide a return. Understanding how to leverage debt can be a crucial part of building wealth.

-

Develop Multiple Income Streams

Relying on a single source of income can be risky. Kiyosaki advises developing multiple income streams to diversify your earnings and reduce financial risk. This could include starting a side business, investing in stocks, or creating digital products.

-

Pay Yourself First

One of the simplest yet most effective pieces of advice from Kiyosaki is to pay yourself first. This means prioritizing savings and investments before spending on discretionary items. By consistently setting aside money for your future, you can build a solid financial foundation.

-

Understand Taxes and Leverage Them

Kiyosaki emphasizes the importance of understanding the tax system and how to leverage it to your advantage. This includes knowing about tax deductions, credits, and strategies for minimizing tax liabilities. Proper tax planning can save you significant amounts of money and boost your overall financial health.

-

Surround Yourself With Financially Savvy People

Credits: DepositPhotos

Finally, Kiyosaki stresses the importance of surrounding yourself with people who are financially savvy. This includes mentors, advisors, and peers who can provide guidance, support, and new perspectives. Being in the company of financially knowledgeable individuals can inspire you to make better financial decisions and pursue your financial goals more effectively.

Conclusion: Become Financially Shrewd

By incorporating these financial nuggets from Robert Kiyosaki into your life, you can pave the way for financial success. His practical advice, rooted in personal experience and a deep understanding of money, offers a valuable roadmap for anyone looking to improve their financial situation.

DISCLAIMER

You should read and understand this disclaimer in its entirety before joining or viewing the website or email/blog list of SmallCapStocks.com (the “Publisher”). The information (collectively the “Advertisement”) disseminated by email, text or other method by the Publisher including this publication is a paid commercial advertisement and should not be relied upon for making an investment decision or any other purpose. The Publisher is engaged in the business of marketing and advertising the securities of publicly traded companies in exchange for compensation. The track record, gains, upside, and/or losses mentioned in the Advertisement, if any, should not be considered as true or accurate or be the basis for an investment. The Publisher does not verify the accuracy or completeness of any information included in the Advertisement. While the Publisher does not charge for the SMS service, standard carrier message and data rates may apply. To unsubscribe from receiving promotional text messages to your phone sent via an autodialer, using your phone reply to the sender’s phone number with the word STOP or HELP for help.

The Advertisement is not a solicitation or recommendation to buy securities of the advertised company. An offer to buy or sell securities can be made only by a disclosure document that complies with applicable securities laws and only in the states or other jurisdictions in which the security is eligible for sale. The Advertisement is not a disclosure document. The Advertisement is only a favorable snapshot of unverified information about the advertised company. An investor considering purchasing the securities, should always do so only with the assistance of his legal, tax and investment advisors. Investors should review with his or her investment advisor, tax advisor or attorney, if and to the extent available, any information concerning a potential investment at the web sites of the U.S. Securities and Exchange Commission (the "SEC") at www.sec.gov; the Financial Industry Regulatory Authority (the "FINRA") at www.FINRA.org, and relevant State Securities Administrator website and the OTC Markets website at www.otcmarkets.com. The Publisher cautions investors to read the SEC advisory to investors concerning Internet Stock Fraud at www.sec.gov/consumer/cyberfr.htm, as well as related information published by the FINRA on how to invest carefully. Investors are responsible for verifying all information in the Advertisement. As an advertiser, we do not verify any information we publish. The Advertisement should not be considered true or complete.

The Publisher does not offer investment advice or analysis, and the Publisher further urges you to consult your own independent tax, business, financial and investment advisors concerning any investment you make in securities particularly those quoted on the OTC Markets. Investing in securities is highly speculative and carries an extremely high degree of risk. You could lose your entire investment if you invest in any company mentioned in the Advertisement. You acknowledge that we are not an investment advisory service, a broker-dealer or an investment adviser and we are not qualified to act as such. You acknowledge that you will consult with your own independent, tax, financial and/or legal advisers regarding any decisions as to any company mentioned here. We have not determined if the Advertisement is accurate, correct or truthful. The Advertisement is compiled from publicly available information, which include, but are not limited to, no cost online research, magazines, newspapers, reports filed with the SEC or information furnished by way of press releases. Because all information relied upon by us in preparing an advertisement about an issuer comes from a public source, it is not reliable, and you should not assume it is accurate or complete.

By your subscription to our profiles, the viewing of this profile and/or use of our website, you have agreed and acknowledged the terms of our full disclaimer and privacy policy which can be viewed at the following link: www.SmallCapStocks.com/Disclaimer and www.SmallCapStocks.com/Privacy-Policy

By accepting the Advertisement, you agree and acknowledge that any hyperlinks to the website of (1) a client company, (2) the party issuing or preparing the information for the company, or (3) other information contained in the Advertisement is provided only for your reference and convenience. The advertiser is not responsible for the accuracy or reliability of these external sites, nor is it responsible for the content, opinions, products or other materials on external sites or information sources. If you use, act upon or make decisions in reliance on information contained in any disseminated report/release or any hyperlink, you do so at your own risk and agree to hold us, our officers, directors, shareholders, affiliates and agents harmless. You acknowledge that you are not relying on the Publisher, and we are not liable for, any actions taken by you based on any information contained in any disseminated email or hyperlink.